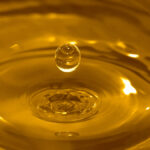

ICE canola futures have steadied, following considerable gains since mid-August, and remained largely rangebound during the week ended Thursday, Oct. 15. Canola prices started the week at $525.30 per tonne, with the November contract losing $2 per tonne on Tuesday. Trade activity was choppy for the rest of the week, and the November contract closed