Lack of China trade deal threatens soybeans, canola market

American soybean growers – and by extension, Canadian canola growers — are, at some point, in for big disappointment on…

American soybean growers – and by extension, Canadian canola growers — are, at some point, in for big disappointment on…

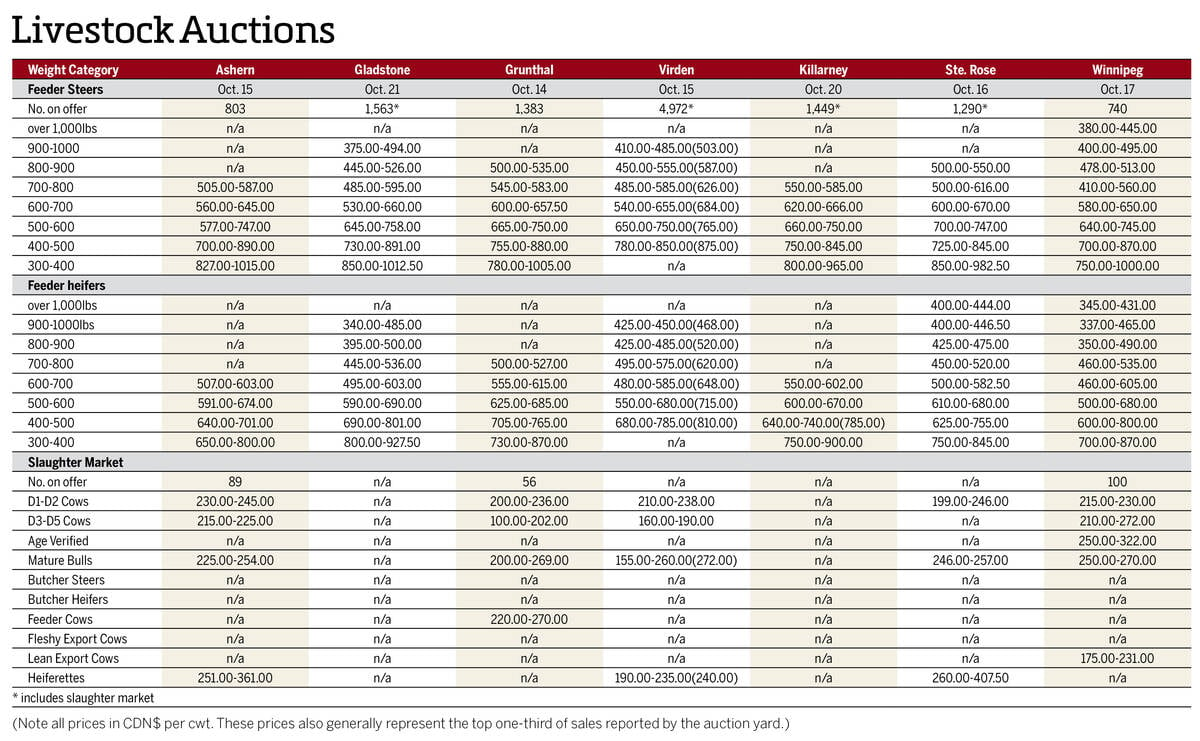

Local cattle sale prices from Manitoba’s seven livestock auctions for the week of Oct. 14-21, 2025.

This year’s Manitoba AG EX returns to Brandon’s Keystone Centre Oct. 9-Nov. 1. Here are the highlights expected from the…

Dormant seeding a hay stand can free up time in early 2026 and give forage a head start against spring…

The U.S.’s global trade advantage on agriculture products is eroding and the deficit is expected to grow, says a University…

Canadian Cattle Association cites little effort to fix ‘non-tariff barriers,’ which they say have already been a problem for getting…

Canadian agriculture is at a pivotal moment as geopolitical, trade, economic and environmental issues are creating tension in the agriculture…