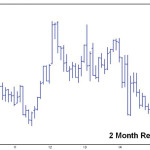

Sometimes it just does not pay to ignore what the charts are telling you. Case in point, soybean meal futures exploded higher after a two-month reversal materialized on the monthly nearby futures chart. This reversal pattern indicated a change in trend and is illustrated in the accompanying chart. Since its development on March 31, the