The path canola as well as other commodities will very likely be determined by the latest earnings report from technology giant, Nvidia, according to analyst Errol Anderson of Errol’s Commodity Wire in Calgary, Alta.

Tech giant, while unrelated to crops, asserts gravitational pull on markets

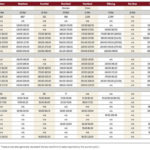

Numbers of cattle at auctions were down from the previous week

Uncertainty has sidelined many participants in the canola market

So far agriculture commodity markets have avoided the worst of the sell-off

Trend-watching can tell us a lot about markets, but won’t necessarily mean better results

A handful of wealthy business people are driving a runaway market in this savoury delicacy