Tag Archives Futures contract

Lean hog futures plunge to a six-year low

Market Outlook: What was first seen as a downward correction was a longer-term trend

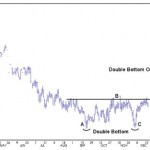

Canola rallies to eight-month high

Market Outlook: Longs move back in when the market bottoms for a second time

Editorial: Will Wheat Commission’s PDQ project have any teeth?

Also, A job for the senators: Answering the unanswered questions of UPOV '91

Key reversal alerts livestock producers to recent downturn

Technical analysis has the ability to cut through the news and see opportunities

Investors lulled by high prices

Ending stocks of corn are likely to begin to drop downwards next year

Canola prices entering sideways trend

The old highs have become the new lows

Crude oil falls to a four-year low

Plunging prices are casting a dark shadow across the commodity sector

Editorial: Wheat prices – a great big mess

KAP calls for mandatory reporting of grain prices

Farmers need more information

Grain commission bonding replacement plan stalls

Insurance industry rules make it difficult to protect farmer payments for delivered grain