Tag Archives Futures contract

Prairie wheat bids decline with U.S. futures

The Canadian dollar declined about half a cent in value over the past week

Some cattle sales called on account of snowstorm

A lower loonie has U.S. buyers again looking north

Big data and agriculture markets: Part 3

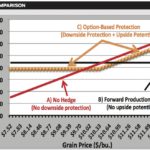

Options-based strategies can help get more out of a chaotic market filled with randomness and unpredictability

Big data and agriculture markets: Part 2

Trend-watching can tell us a lot about markets, but won’t necessarily mean better results

Big data and agriculture markets: Part 1

We’re awash in market information and using modern approaches can help manage and understand it all

As the year closes, some troubling numbers

Wall Street, the 'Trump bump' and the near future for commodity markets

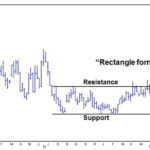

Drozd: Oat futures rally to a one-year high

Market Outlook: The increase might seem sudden but charts predicted upward movement

Spring wheat futures stuck in a rut

MGEX spring wheat futures are rangebound and going nowhere fast

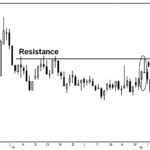

CBOT wheat futures slide down to a 10-year low

Downward movement comes after a very clear technical signal presented itself on the charts

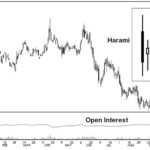

Drozd: Bear trap catches shorts looking down at bottom of soybean market

As they scrambled to cover (buy back) their positions, the market was propelled higher