CNS Canada — Higher interest rates and a stronger Canadian dollar relative to U.S. currency is giving Canadian farmers a double whammy. According to Farm Credit Canada’s chief agricultural economist, it’s also a situation farmers will likely have to deal with for at least the remainder of the year. J.P. Gervais said he thinks farmers

Tag Archives Canadian dollar

Farmers to deal with stronger loonie for rest of 2017

Strong loonie not major threat: FCC economist

Canada still competitive with an 80-cent dollar

The Canadian dollar’s flirtations with the 80 U.S. cent mark is not likely to undermine agriculture’s potential for the rest of the year, said the principal agricultural economist at Farm Credit Canada. When FCC issued economic outlooks for agriculture back in January, it said the low dollar relative to the U.S. currency had been a

Hard red spring wheat bids correct lower

Hard red spring wheat bids in Western Canada ran into some technical resistance during the week ended July 7, as the rally that had sustained a meteoric rise in wheat country subsided on ideas the gains were overdone. Depending on the location, average Canada Western Red Spring (CWRS) wheat prices were down by $17-$22 per

CWRS wheat bids rising with U.S. weather concerns

A stronger loonie during the week accounted for a decline in basis levels

Hard red spring wheat bids in Western Canada continued to rise with U.S. futures during the week ended June 16, as hot and dry conditions in the major wheat-growing regions of the Dakotas and Montana floated all boats. Depending on the location, average Canada Western Red Spring (CWRS) wheat prices were up by $7-$10 per

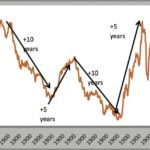

Separating your commodity and currency decisions

Currency fluctuations can be almost as significant as changing prices for your farm products

Since we live in Canada, while almost all commodities are traded around the world in U.S. dollars, the Canadian dollar/U.S. dollar exchange rate will have an impact on your farm revenues. And since it directly or indirectly affects almost 100 per cent of your revenues, the Canadian dollar/U.S. dollar exchange rate can and should be

Diesel prices soften, but watching U.S. infrastructure plan

CNS Canada — Sinking prices for crude oil and a softer Canadian dollar have kept diesel prices relatively low for Canadian farmers in 2017, and they could be heading lower, as long as U.S. President Donald Trump’s infrastructure plan doesn’t get in the way. “I would probably say in Canada you’re going to see numbers

Weaker loonie draws U.S. cattle buyers to Manitoba

Prices have local buyers seeking out bred cattle

Cattle moving through Manitoba’s auction yards saw some strength during the week ended March 3, as a combination of rising U.S. futures and a weaker Canadian dollar gave local prices a boost. Heartland Livestock Services at Virden was the busiest auction yard in the province during the week, holding three sales: a bred cow sale,

Plentiful feed supplies weigh on feed barley prices

CNS Canada — A steady stream of fusarium-damaged wheat is flooding Alberta feedlots these days, giving ranchers a variety of choices on what they can give to their animals — but also keeping feed barley prices in check. “That has definitely been heavy on the barley,” said Allan Pirness of Marketplace Commodities in Lethbridge. That

OPEC announcement could boost ag markets, maybe

CNS Canada — The bearish malaise that has gripped the North American agricultural market shows no sign of breaking soon, and it could take a major disruption, say such as a hike in oil prices, to lead the way higher, according to some industry watchers. “Let’s say we go to US$55 (per barrel). That would

Editorial: Armchair economist

It’s been said that anyone who thinks about economic forecasts for more than about a half an hour a year is wasting their life. A professional economist told me that, and what she was getting at is the intractable nature of economics. Even the experts can’t agree on what’s happening, or has happened, never mind