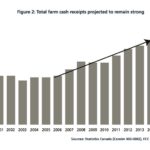

Reuters — Canadian farmers’ debt will likely reach another record high this year, while land appreciation slows and incomes flatten, but the industry is still in strong financial shape, the country’s biggest agriculture lender, Farm Credit Canada, forecast on Tuesday. FCC, the federal Crown ag lending agency, sounded a note of caution for farmers, who