When it comes to ICE canola futures, there’s one thing to keep in mind: tight canola supplies. Those shrinking old-crop supplies will continue to support canola and provide a good reason for prices to climb.

That was quite evident March 4 when the May canola contract rose by its daily limit of $30 per tonne during morning trading. As the session wore on, the May pulled back, to eventually close $15 higher. While unable to pierce the $800-per-tonne threshold that day, May canola still set new highs, as did other contracts. Nevertheless, canola pushing above $800 per tonne, as the March contract did a few times, is not out of the realm of a possibility.

Read Also

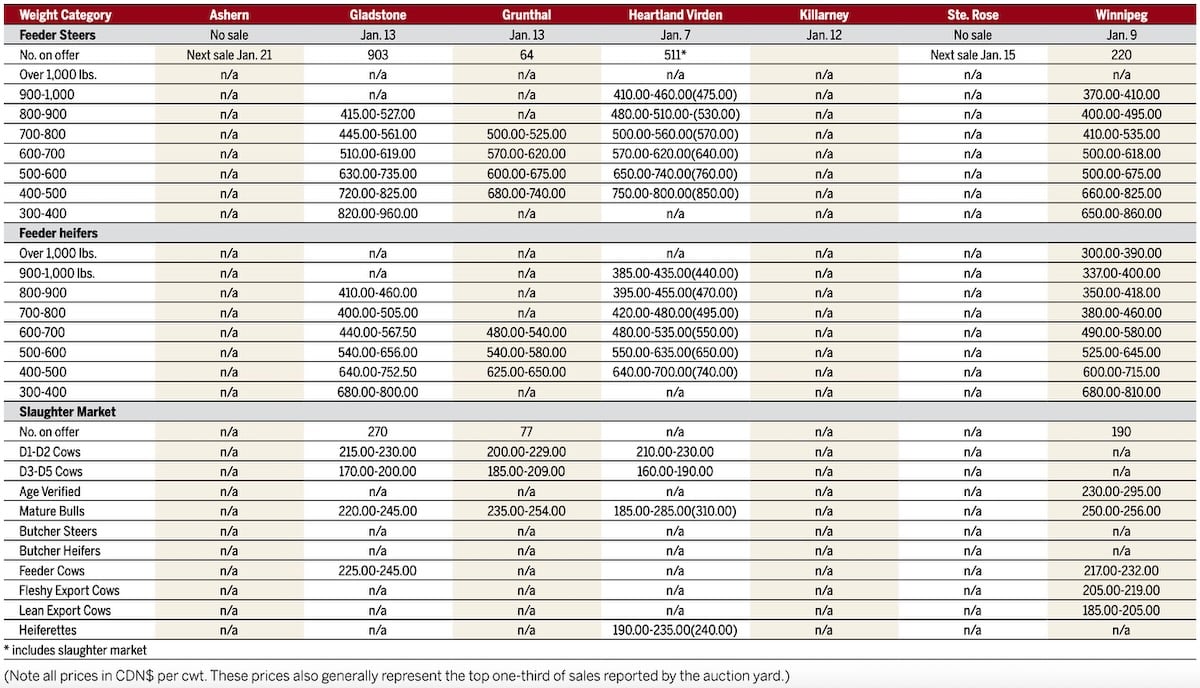

Manitoba cattle prices, Jan. 15

Although canola has been showing independence from time to time, it was also clear that a spike in soyoil on the Chicago Board of Trade was quite supportive. But inevitably for canola, it all comes down to that remaining old-crop supply getting smaller and smaller.

The latest numbers from the Canadian Grain Commission (CGC) highlighted those tight supplies. At 29 weeks into the 2020-21 marketing year, producer deliveries reached 13.41 million tonnes, more than 14 per cent ahead of those the previous year.

In addition, the CGC reported canola exports remain well ahead of 2019-20. To date, about 6.99 million tonnes have been shipped overseas, up about 32 per cent over last year. Also, domestic usage this year, at more than 6.16 million tonnes versus 6.03 million, has been staying ahead of 2019-20.

Agriculture and Agri-Food Canada last month pegged ending stocks for 2020-21 at 700,000 tonnes, which means there’s very little canola left in Canada. The department forecast ending stocks for 2021-22 to be 700,000 tonnes as well, despite production bumping up by about one million tonnes, at more than 20 million.

Unless there’s some kind of a dramatic shift in the market that develops, tight ending stocks will continue to underpin canola values for some time.

There still can be a few wrinkles in the mix, such as that major bulge of South American soybeans that will soon dominate the global market. Despite wet conditions slowing the soybean harvest in Brazil and dry conditions in Argentina threatening to impede that country’s soybean crop development, a record amount remains destined to be taken off the fields in the coming months.

Already soybean prices in Brazil are markedly cheaper than those on the Chicago Board of Trade. Should those lower prices drag on the CBOT soy complex, the high canola prices we see now could pull back.

And that’s a point someone still sitting on his or her canola should ponder.