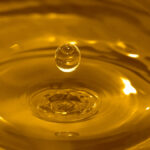

The ICE Futures canola market saw some choppy activity during the week ended Feb. 17, generally holding rangebound just below the highs hit earlier in the month. The relatively steady tone in canola came despite broader gains in outside vegetable oil markets, as canola had been looking overpriced compared to competing oilseeds for some time.