There isn’t much to prop up canola values — at least if it were to show some independent strength.

Traders and analysts have pointed out that old-crop canola has pretty much run its course. As we plow through winter with eyes turning to spring, attention is beginning to shift away from the old-crop months to the new-crop positions — and the latter are looking rather good, holding far above $800 per tonne during the week of Feb. 7.

The argument goes that old-crop values would take a very hefty hit if the oilseed market fell back. That was at least partially shown during the Feb. 10 session, in which canola climbed toward new contract highs, but fell back when profit-taking took hold of the market, forcing prices to drop.

Read Also

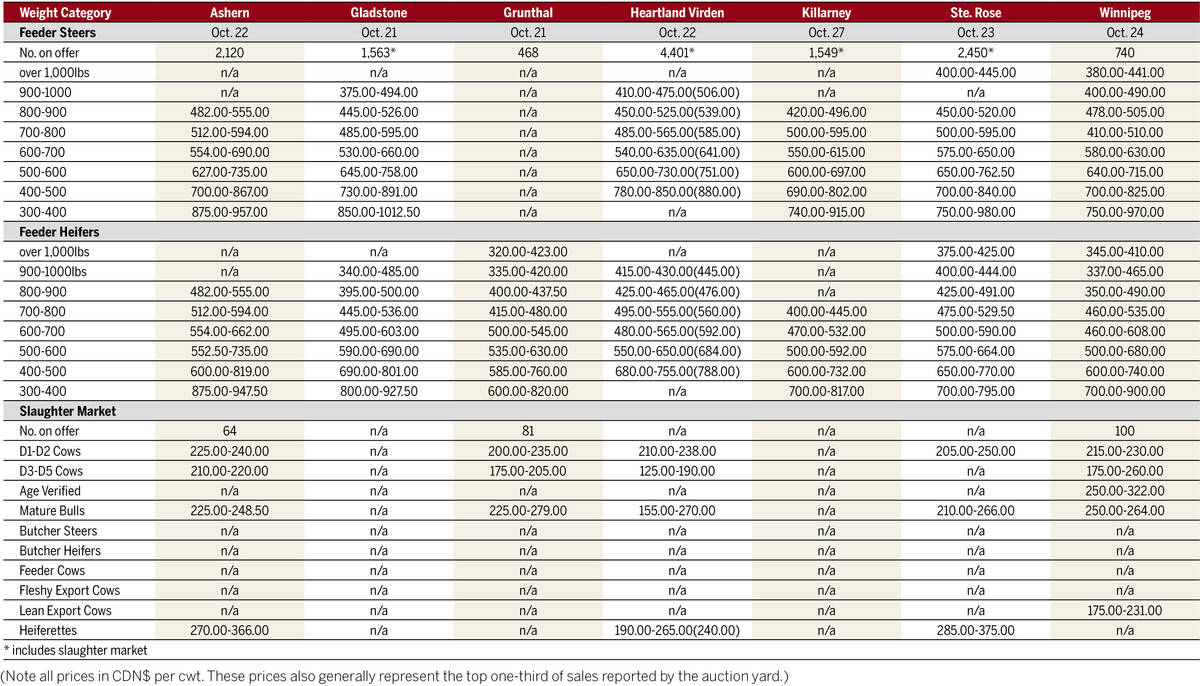

Manitoba cattle prices – Oct. 28

Local cattle sale prices from Manitoba’s seven cattle auctions for the week of Oct. 14 to 21, 2025.

There remains the fact that canola supplies in Canada are extremely tight and high prices are needed, not only to extract what’s still left in farmers’ bins but to curtail exports.

As for edible oil prices on Feb. 10, the central reason for their hike was quite simple — the ongoing decline of Brazil’s crop was made clearer when CONAB, that country’s equivalent of the U.S. Department of Agriculture, chopped 15 million tonnes from its production estimate. Brazil bean production is now estimated to be 125.5 million tonnes.

With thoughts of another record bean crop for Brazil left in the dust, the drought that has gripped much of the country’s south has seen repeated private and government forecasts slide downward. A sort of race to the bottom has now ensued, raising more dust to cloud the course Brazil soybeans should be on.

There are traders and analysts who believe CONAB was too aggressive in lopping off a little more than 11 per cent from its previous projection. Just the same, there are those who think USDA was too conservative with its guess of 133 million tonnes when it issued its world supply-and-demand estimates the day before.

That sharp cut by CONAB created a flurry of hikes in the Chicago Board of Trade soy complex, which also rippled through European rapeseed and into ICE canola futures. Up canola prices went.

Down went canola prices when Chicago beans saw those handsome gains curdle into significant losses. After hitting contract highs, profit-taking seized the rest of the day. As soybeans and soymeal pulled back, along with weakening crude oil prices, canola gave up its ground, soon finding itself with losses as well. Only with some strength left in rapeseed and in Chicago soyoil did canola come away from its lows that day.

The drought in Brazil has done its damage, and now it’s a matter of zeroing in on what production can be. The amount of soybeans to be harvested will affect edible oils for coming weeks, dragging canola with it regardless of direction.