Despite turmoil around the world due to the COVID-19 pandemic, canola prices didn’t change much from week to week.

ICE Futures’ May canola contract closed March 20 at $461.70 per tonne; by March 26, May canola was at $462.80 per tonne.

Fuelling that steadiness has been soyoil on the Chicago Board of Trade (CBOT). Closely connected to world crude oil prices, ‘beanoil’ has had its share of ups and downs since the price war between Saudi Arabia and Russia started earlier this month.

The price war saw crude oil prices plummet, with West Texas Intermediate losing more than US$30 per barrel, to sit in the low US$20s.

Read Also

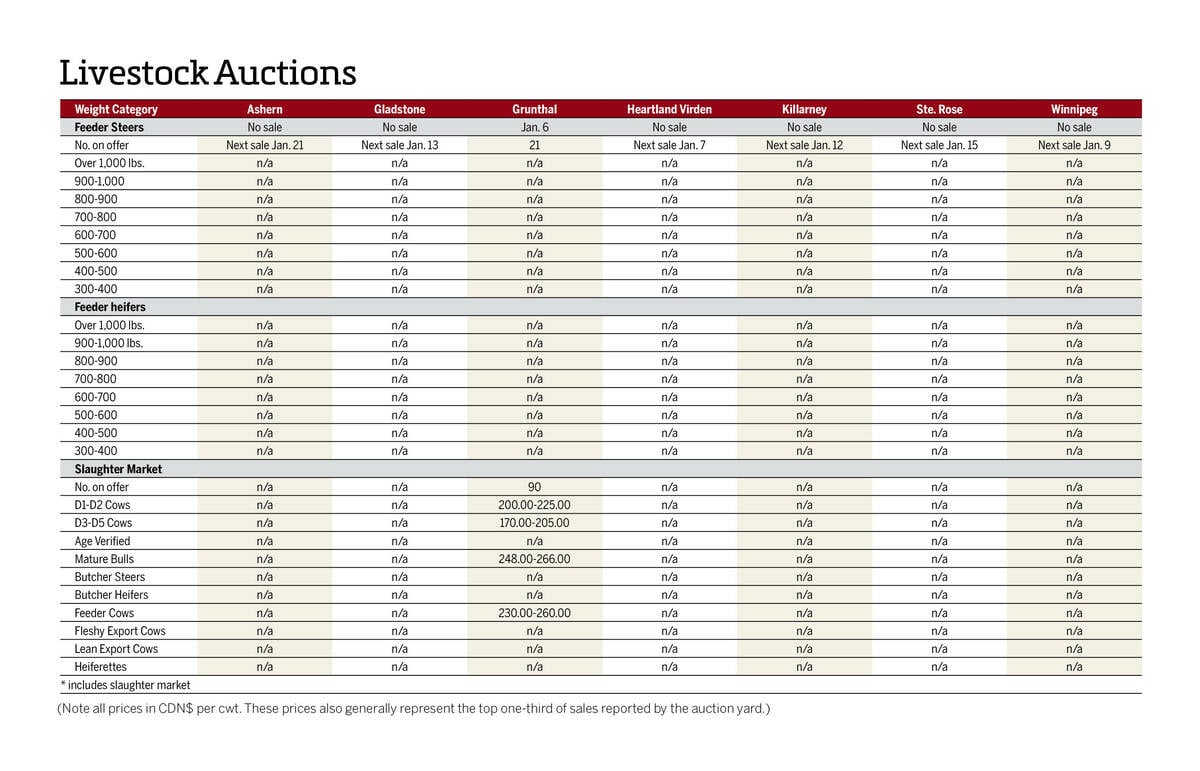

Manitoba cattle prices Jan. 6

Grunthal was the first Manitoba livestock auction mart to kick off 2026 cattle sales in early January.

On a side note, Western Canadian Select has tumbled dramatically as well, finishing around the US$7 mark on March 26. By midday on March 27, WCS dipped under US$5/barrel.

As one trader noted this week, soyoil rallied back as crude oil regained some of its lost strength. Of the edible oils on the world market, canola is most closely aligned to soyoil.

Also helping canola prices has been the slide in the Canadian dollar, which tumbled under 69 U.S. cents but now hovers a little above 70 U.S. cents. Canada’s exports are dependent on a cheaper loonie and exports are crucial to canola.

That said, the Canadian Grain Commission reported an increase in canola exports for the week ended March 22. Exports reached 335,400 tonnes, a marked improvement over the 226,300 tonnes the previous week.

Farmer deliveries remained strong as well, with 406,800 tonnes on the week as of March 22. That’s a small decline from the 415,700 tonnes the previous week.

However, road bans are now in full effect across the Prairies and until they are lifted, deliveries could dip.

Despite volatility in markets, and in the world, due to the pandemic, canola is one thing that’s holding on — so far.