Canola continued to fall back during the week ended Sept. 1, pulled lower by a number of factors.

Over the course of the week, the nearby November contract lost $21.70 per tonne, to close at $812/tonne on Sept. 1. The January 2023 contract was down pretty much the same amount, losing $21.30 at $821/tonne.

In the lead-up to the Statistics Canada production report on Aug. 29, the trade called for more canola than federal agency’s previous estimate of 18.4 million tonnes for 2022-23. Despite well-discussed issues with wet and dry conditions across the Prairies, there was pretty good weather to spur on a decent crop. Nothing spectacular, no bumper harvest, just something middle-of-the-road to help the canola recover from last year’s devastating drought.

Read Also

Market impacts of canola headlines need digesting

January 2026 has been quite the month for Canadian canola trade, how will it all ripple out in the market?

Things were coming along quite nicely when a good amount of heat very likely zapped a potential plus-20 million-tonne harvest.

At 19.5 million tonnes, StatsCan’s new projection seems good, but there’s a catch. The satellite imagery for the report was done before the heat took its toll on prairie crops. That brought a bit of market skepticism about the number. Nevertheless, it gave the market something to go on and set a direction – and canola went lower. On the day of the report, the November contract lost $17.30 and the January fell $17.50.

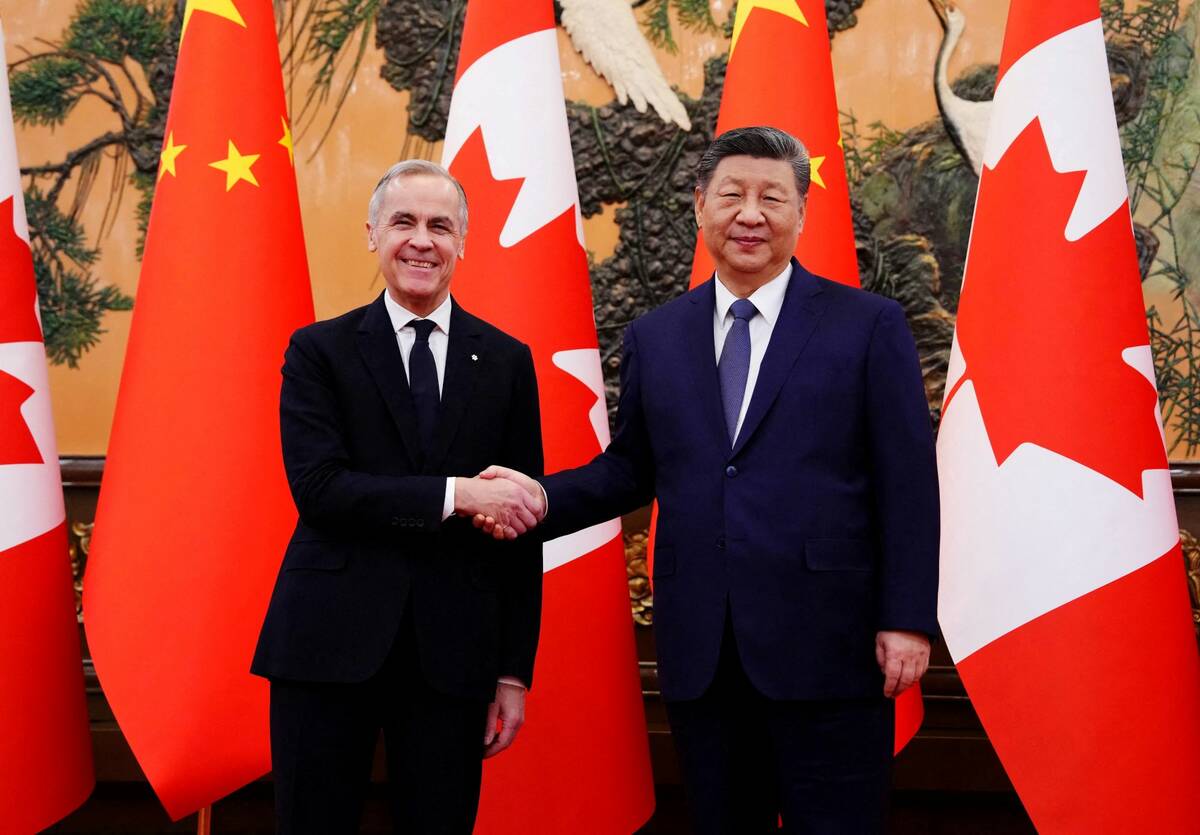

As losses continued into the following day, canola began stepping away from its lows. Within the last hours of trading, the Canadian oilseed finished higher. The reason was said to be buying by China. The speculation was that canola had dropped enough and Chinese firms entered the market, scooping up what they could. At $5.30 and $6/tonne, these weren’t big hikes, but a nice improvement.

No good gain goes unpunished in the market, as weakness in the vegetable oil complex as well as global crude oil prices drove canola lower.

Essentially concerns over demand for crude oil pulled prices downward. As COVID-19 took another firm grip on China, its need for crude began to recede as did its demand for vegetable oils.

The Chicago soy complex stepped back, European rapeseed fell, and Malaysian palm oil became weaker. The pressure forced canola lower.

With harvest picking up steam across the Prairies, canola prices could be heading lower. One saving grace would be those crazy crush margins, which are estimated at almost $235/tonne for November-October to more than $132 a year from now. Such big margins will drive up demand, which could see prices move higher or at the very least temper losses.