The big numbers of the Ukraine war

Both players are major resource providers that will cast a long shadow on economies

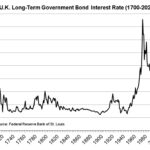

How high could interest rates go?

The consensus is they’re set to rise but many could be underestimating how much

Your grain marketing multi-tool

Using options can help you accomplish many marketing goals with less risk

How to market grain in our current environment

A conversation from the Between The Rows podcast can give you some insight

Global factors key in changing ag landscape

China, Russia, biofuel trends among factors likely to affect future market risks

Put the cash advance to work in your marketing plan

The APP can give you the flexibility to plan commodity sales and optimize the prices you receive

Hyperinflation requires certain triggers

Inflation is more common and easier to plan and invest for

Watch with interest, what goes down…

Rates will have to go up someday, but nobody can predict when

Is inflation risk overhyped?

A lot of people — perhaps too many — are talking about inflation

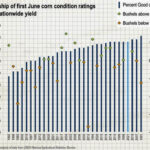

Lots of weather left this growing season

Examining the numbers suggests a poor start doesn’t doom a crop