“Rain makes grain,” or “Seed into dust and the bins will bust,” and of course, “Wheat is a weed, you can spit on it and it will grow.”

All these old sayings are really great because there’s a lot of truth in those time-tested nuggets of wisdom. Anecdotal sayings have a lot of validity to them, but so too do numbers and statistics. Data and probability analysis can help with grain marketing every year and hopefully also in a year like this where weather and drought are dominating the headlines.

Read Also

Thunderstorms and straight-line winds

Straight-line winds in thunderstorms can cause as much damage as a tornado and are next on our weather school list exploring how and why severe summer weather forms.

All this will be nothing new to farmers who have been working the land for years or even decades, but it’s still good to take a step back to look at the bigger picture and remind ourselves of some numbers. So, here’s some recent weather analysis to provide some insights and maybe even a bit of clarity as we navigate through this current weather market early in the growing season.

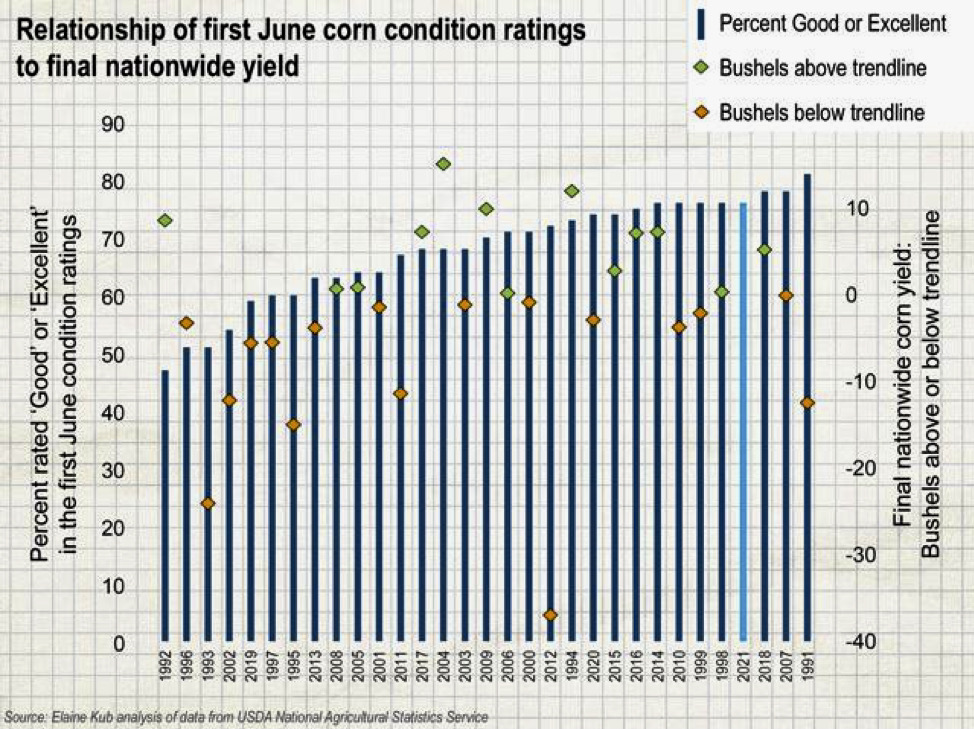

The first is a recent article called “Good Corn Conditions in June Don’t Necessarily Mean Good Corn Yields,” by Elaine Kub in DTN’s Progressive Farmer. As the title suggests, she shows that “condition ratings have limited predictive power this early in the season.” For instance, “comparing the first June corn condition ratings from the past 30 years against each year’s ultimate corn yield (how far it turned out above or below trendline expectations) is pretty unsatisfying. There is an almost meaningless correlation of 0.23 between the two data series. But not totally meaningless! “Among those years that did have notably poor nationwide condition ratings right away in June (60% or less rated “good” or “excellent”), almost all of those years also turned out to have relatively poor final nationwide yields.”

The article goes on to say that “it doesn’t always work that way (1992 started with only 47% of corn fields rated ‘good’ or ‘excellent’ then went on to yield nine bushels above trendline expectations on nationwide.) “And the inverse frequently isn’t true — great nationwide conditions right away in the growing season don’t reliably predict great nationwide yields at the end of the growing season. They may turn out well in some years (1994, 2014, 2016, 2018), or they may ultimately disappoint in other years (2007, 1991). Recall that the first June condition ratings for the 2012 crop showed 72% of the corn crop rated ‘good’ or ‘excellent’ but then the weather events of the summer ensued and the nationwide average yield of 123.1 bushels per acre was 37 bushels below trendline expectations,” Kub said.

“Perhaps all we can conclude is that a bad start is bad, but a good start isn’t much of a guarantee. A good start is merely the absence of a bad start.”

This year (2021), the USDA’s nationwide numbers say 76% of the U.S. corn crop is in “good” or “excellent” condition. But it may not tell us much about what U.S. corn yields will be this fall. Crop condition ratings are generally pretty good in June, because it’s simply too early for anything to have gone wrong… yet. Wait for July or August.

I’ll also note that when looking at her chart, you can see that most of the yield surprises over those past 30 years are usually to the downside. This is some good food for thought when contemplating this year’s crop situation so far.

The next is an early-June article by Karen Braun from the Reuters news service called “Strong U.S. corn conditions give promising start to pivotal harvest.” She has done some really good analysis over the years and she started this one by saying “…the U.S. Department of Agriculture’s statistics branch placed 76% of the U.S. corn crop in good or excellent condition as of Sunday, well above the trade guess of 70%. Within the past decade, the initial corn rating came in at 76% one other time (2014) and above it twice: 79% in 2018 and 77% in 2012. The initial scores in those three years were the highest of the season, though 76% appeared a couple other times in 2014. Not all market participants are fans of crop conditions given the subjective nature, but there are some identifiable trends. There is not a lot of downside to yield potential when early corn condition scores top 70%. The only major exception was in 2012 when a massive drought followed the initially promising start. The best corn harvests are not associated with early corn conditions below 70% good-to-excellent. One exception to that might be 2017 when the initial 65% score somewhat masked the strong potential, and the crop went on to a record 176.6 bushels per acre.”

Kub also notes that “…there is not as strong a relationship between initial soybean conditions and final yield outcomes, possibly because of the high dependence on timely rainfall later in the season. Some of the better crops had initial ratings below 65%, but the lowest early scores tend to be associated with below-trend yields.”

As a final related point, I was also recently reminded that bumper crops are no less likely when seeding into dry soils as compared to seeding into moist soils; it’s the rainfall and soil moisture during the rest of the plant’s growth that will affect the final yield.

Bottom line, weather markets make for both a challenging production and pricing environment. There’s still a lot of weather and growing ahead of us so it’s way too early to guess at final yields. Pricing opportunities will come and go so capturing these great prices on a portion of your production is a good idea. Fortunately, option strategies that complement physical sales give you the downside protection you need and the upside potential you want, all while managing production risk since you don’t have to commit your grain for delivery. And in a dry year like we have now, this could be the most valuable option of them all.