Tag Archives finances

Producers protest change to 2025 cash advance program

The 2025 interest-free portion for advance payments has been lowered back to 2021 levels

How farmers can navigate the capital gains tax maze

Tax expert says the tax-free rollover can be the farmer's best friend in succession cases, if they're worried about the spike in capital gains tax inclusion

When it comes to getting farm grants, not all advisors are equal

Farmers will want to know their potential farm consultant's credentials, fees, services and successes when hiring

FCC Indigenous finance team tackles borrowing barriers

Farm lender provides ‘à la carte’ loan options to First Nations farmers

Farm Credit Canada funds alternative lending company

What is harvest costing you?

Online tools exist to help producers calculate fall costs

Advance loans attract farmers despite lower interest-free portion

Farm cash applications rise year-over-year, program administrators say

Producers look for credit bridge

High feed needs, plus low feed supply, plus less than optimal cash flow means producers are looking for a financial boost to get them through to spring

Put the cash advance to work in your marketing plan

The APP can give you the flexibility to plan commodity sales and optimize the prices you receive

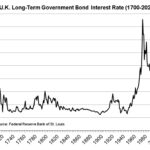

Watch with interest, what goes down…

Rates will have to go up someday, but nobody can predict when