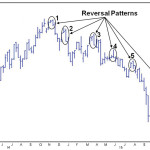

The live cattle market has been under pressure since the nearby futures market at the CME peaked at $171.975 per hundredweight in October 2014. In the 14 months that followed, prices on the weekly nearby live cattle futures chart plummeted $55/cwt to $116.975/cwt, before recovering $20 per hundredweight. Although the downturn was sudden, and may