The cost of using options to lock in a floor price for crops is tied to the floor price.

The higher the floor price, the higher the cost of what is essentially an insurance premium.

If a farmer pays, say, $1 a bushel to lock in a minimum canola price of $16 a bushel, the farmer will earn at least $15 a bushel — $16 when they deliver the canola to the elevator, less the $1 they paid for the option.

Say a farmer locked in $16 a bushel and hopes to grow 40 bushels an acre on 500 acres. It would cost $20,000 in options (40 bushels/acre X 500 acres = 20,000 bushels X $1/bushel = $20,000).

Read Also

MANITOBA AG DAYS: Don’t wait to buy fertilizer, farmers warned

Higher fertilizer prices likely ahead, says Ag Days speaker. Farmers waiting until spring to buy fertilizer might end up eating the cost.

If the elevator price goes to $20 a bushel the farmer can capture that price by not exercising their $16 option. The gross return from selling 20,000 bushels at $20 a bushel is $400,000. After deducting the cost of $20,000 cost of the options the farmer would gross $380,000 or $19 a bushel.

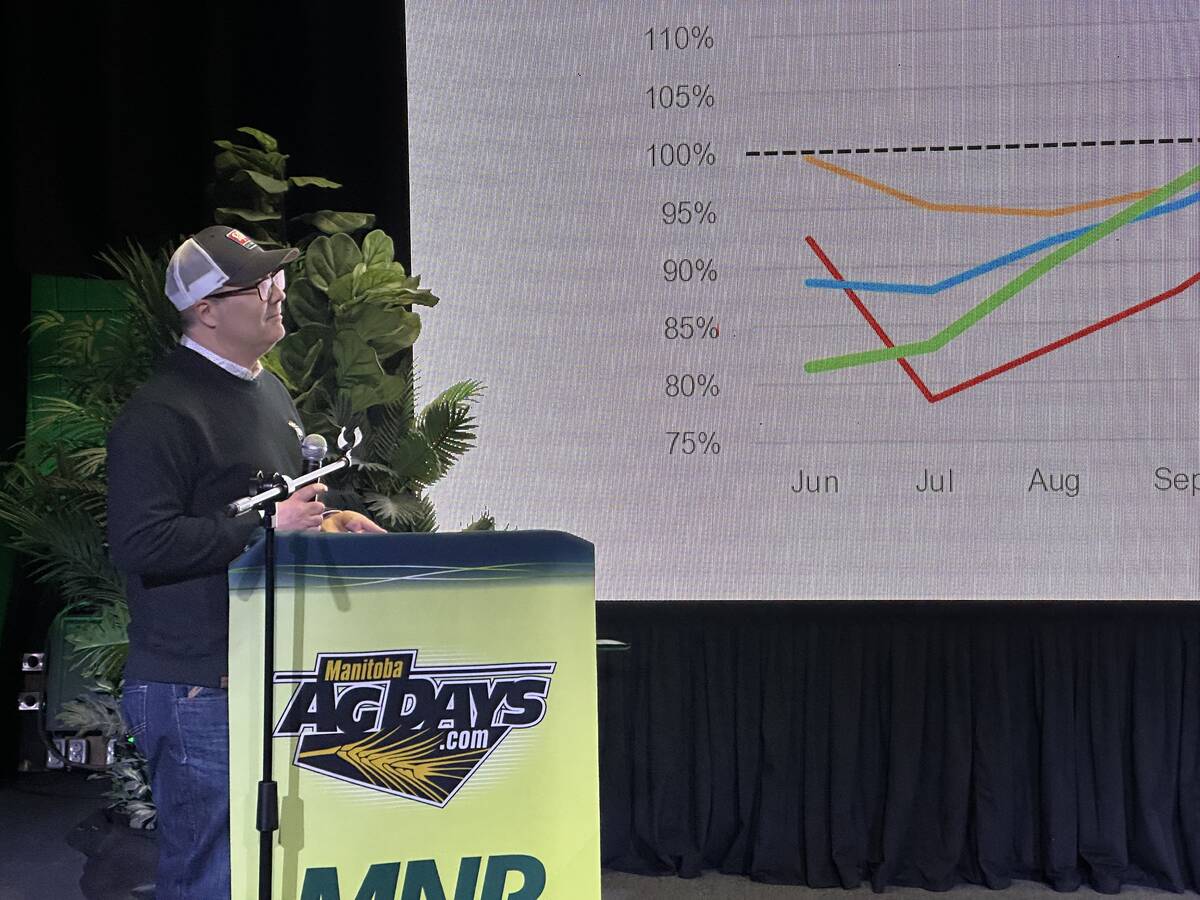

According to Warren Ellis, former owner of Ellis Seeds, traditionally when canola prices are at $16 a bushel it’s more likely they will fall than go up — except this year.

It’s unlikely any farmer would have sold 40 bushels an acre from 500 acres of canola, or 20,000 bushels, before it was grown. But if they had, and they couldn’t deliver because of a crop failure, they would have to come up with, in this example, at least $80,000 to buy back the contract or buy the canola elsewhere. ($80,000 is the difference between $400,000 canola is worth now at $20 a bushel and the $320,000 for the canola the farmer sold for $16 a bushel.)

The options advantage over elevator pricing is it allows farmers to lock in a minimum price on as much crop as they want without worrying about having to deliver if there’s a crop failure, Ellis said.

Most farmers, because of the production risk, will only price a portion of their crop until it’s in the bin, he said.

Say this farmer spent $20,000 on options and harvested no canola. That’s a lot of money for no return, the $20,000 spent on options. But it’s less than what they might have had to pay had they priced through the elevator.

Say this farmer spent $20,000 on options and had average crop insurance coverage of 30 bushels an acre their crop insurance payout of $168,450 (30 bushels an acre coverage X $11.23 a bushel in crop insurance payments X 500 acres) would easily cover the option costs.

The cheapest option in the case of zero production would have been not to buy options or price through an elevator contract. Fortunately complete crop failures are rare.