When thinking about risk, there can be a lot of different interpretations. Risk does not have to mean volatility but the two tend to work in conjunction. One way to define risk is ‘the consequence of not meeting your goals.’

One of my favourite authors on the topic of market risk and practical trading ideas is Nassim Taleb. He has written many books with his most influential being The Black Swan: The Impact of the Highly Improbable. A ‘black swan’ has entered our everyday business, political and social vocabulary to describe a previously unseen event that has a dramatic impact and even changes the way we look at things forever.

Read Also

Canadian canola prices hinge on rain forecast

Canola markets took a good hit during the week ending July 11, 2025, on the thought that the Canadian crop will yield well despite dry weather.

Taleb has written many other books and combined they offer a good starting point to think about markets and risk. One of his most insightful and thought-provoking sayings is, “Volatile things are not necessarily risky. Risky things are not necessarily volatile.” History is full of market situations that weren’t very volatile, but ultimately proved to be very risky.

First, for instance, we have the well-known implosion of the U.S. mortgage market in 2008 where for years, if not decades, money flowed in to the mortgage-backed securities market with prices trading steadily near 100 cents on the dollar. As this game played on, excessive leverage, loose regulations and greed seeped in, creating a perfect storm for collapse. After years of relatively low volatility, the real risk was uncovered and prices dropped anywhere from 20 per cent on better AAA-rated paper to 80 per cent on lower-quality BBB-rated securities, causing ruin for many.

Do you also remember what happened with the euro-Swiss franc currency peg in early 2015? From 2012 to 2105, the EUR/CHF exchange rate had very low volatility of less than five per cent, quite low by currency market standards as the Swiss central bank sold the franc and bought the euro to weaken the franc and peg the two currencies together. Then one day, the Swiss central bank stopped buying the euro to discontinue the currency peg. Instantly, the Swiss franc increased almost 40 per cent versus the euro overnight, causing significant losses, especially for any highly levered entities in that market. This is a very explicit peg, but many markets have implicit pegs driven by the relative value between commodities.

High risk for farmland

A current example of a low volatility with high potential risk scenario, while not as dramatic but similar nonetheless, is the canola market. As of this writing, canola futures have held up well around C$500/tonne despite soybeans dropping US$2/bushel from US$10.50 to US$8.50. The price ratio between the two is now in the top 10 per cent of the historical range, meaning canola is relatively expensive compared to soybeans. Furthermore, canola volatility has been very low, only 12 per cent compared to more than double the 26 per cent level for soybeans. So far, canola is defying gravity. While it doesn’t mean that canola has to follow soybeans lower, the potential is certainly there. This is an example of low volatility but potential high risk for growers if canola drops.

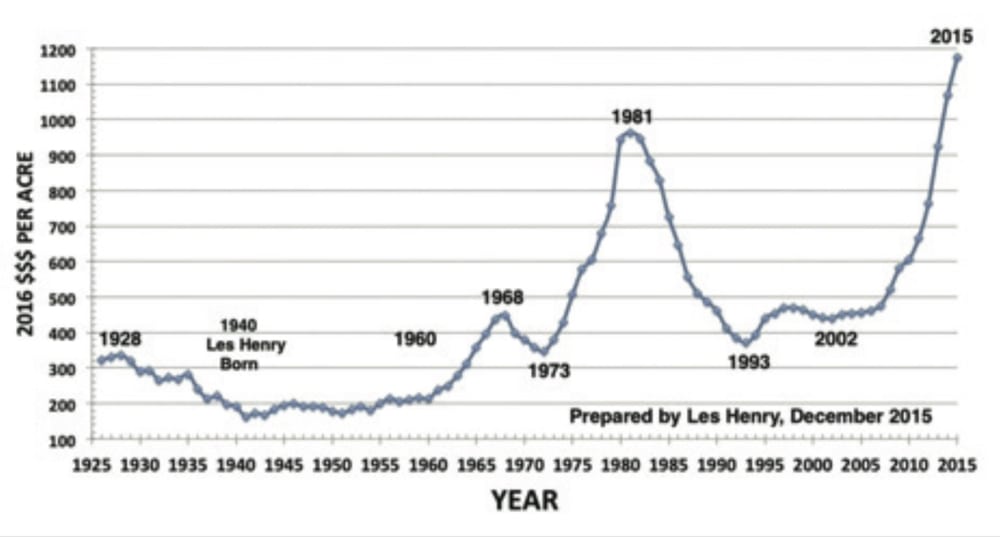

Another current situation of low volatility but high potential risk is farmland prices. In the past 25 years since 1993 when prices started going up, the average annualized volatility of farmland values across Ontario and the Prairies has been only six per cent, using FCC data. By comparison, the long-term volatility of the U.S. stock market is about 12.5 per cent, the Canadian stock market is approximately 15 per cent, and long-term government bonds is around 10 per cent.

Farmland prices could be considered particularly at risk since a lot of one-way buying has built up over years or even decades, helped in part by interest rates falling from 20 to two per cent. How could a further increase in interest rates impact farmland price? It is extremely difficult to say for sure since so many factors will impact price. But consider this: if rates go from two per cent to even five per cent or six per cent, the average of the last 30 years, a 50-year bond — a very long-term asset just like real estate, would drop about 60 per cent.

Year in, year out, land prices have not been volatile but could be considered risky, especially if you borrowed too much money to buy a lot of land at these high levels and interest rates continue to go higher. So at the end of the day, risky things are not necessarily volatile.

Likewise, volatile things are not necessarily risky. Commodity futures prices might be volatile, just like cash grain or livestock prices, but hedging with futures and options isn’t necessarily risky — highly levered or speculative trading is. And it’s usually leverage or overtrading that gets us in trouble.

Use a simple approach

Since you can’t use options and futures to protect durum, peas, lentils or barley in the same way as canola, cattle or the Canadian dollar, it makes sense to use these revenue-management tools where and when you can. In fact, relying on just physical grain-marketing contracts like cash sales off the combine, deferred delivery or basis contracts, subjects you too greatly to the cash market and grain-handling industry.

Straightforward, easy-to-use futures and options hedging strategies usually provide the best results because people are more likely to use a simple approach. What’s the point of developing a more intricate mousetrap if no one uses it? And, hedging doesn’t have to be looked at as just a precautionary speed bump or yellow light. It can also be seen as a green light to take advantage of favourable pricing in the markets that you can’t replicate with the physical.

Bottom line, futures and options are not necessarily risky and can in fact help you deal with volatility. Implementing a hedging program is increasingly becoming standard farm business practice just like seeking expert legal guidance and accounting advice or working with agronomic consultants. Too often, people say it is too costly or too complex or too time consuming to implement a proper hedging system. History shows it could be too costly not to.

Doing nothing shouldn’t be an option anymore. It could even be more risky since your market exposure is greater without strategies to offset risk, balance opportunities and meet your goals. Diversified marketing strategies allow you to be in better control, be proactive rather than reactive and help you look at risk as well as volatility in a new light.