It’s that time of year again, as another calendar page turns. I’m sure we’re glad to see the end to this year, although that doesn’t mean things have magically changed on January 1. At least now we can take a look back with a better understanding of where we’ve been to help figure out where we may be going. But, as Yogi Berra is quoted as saying, “The future ain’t what it used to be.”

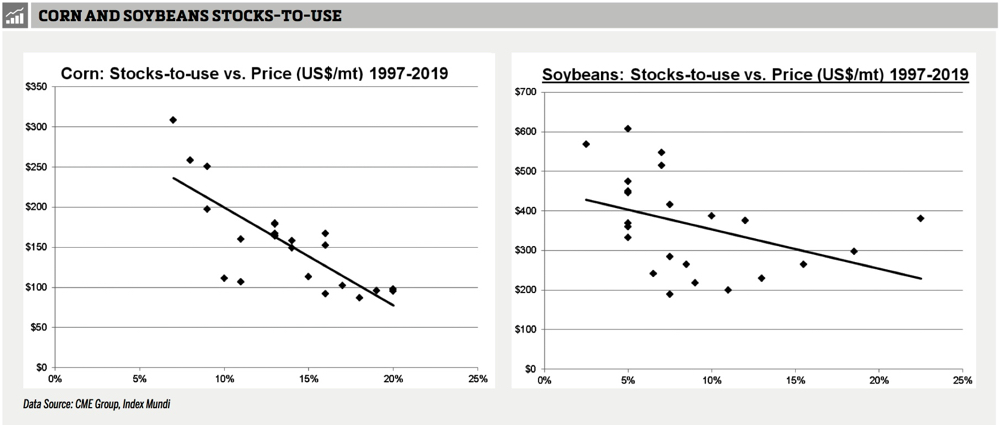

First up, how have commodity prices done in 2020? Overall, the Bloomberg Commodity Price Index is down about seven per cent for the year but when you look closer, the details show a lot more variability. At the COVID-induced lows in April, the whole commodity index was down as much as 27 per cent. Some commodity sectors have performed better than others. Metals are up 15 per cent to 20 per cent and agriculture commodities are up around 10 per cent but energy is down 25 per cent. Within the agriculture sector, at the time of writing in mid-December, soybeans are up around 25 per cent year to date, canola 15 per cent, wheat and corn around 10 per cent but cattle has fallen 10 per cent and hogs are off by five per cent.

Read Also

Canadian canola prices hinge on rain forecast

Canola markets took a good hit during the week ending July 11, 2025, on the thought that the Canadian crop will yield well despite dry weather.

When it comes to currencies, the U.S. dollar index was down about six per cent but like every other market in 2020, there have been a lot of fluctuations. At one point during the height of the COVID-induced turmoil in March, the U.S. dollar index had jumped as much as eight per cent. The Swiss franc, a perennial safe haven, and the euro, the biggest alternative to the U.S. dollar, are now both higher by about nine per cent. Meanwhile, the British pound, with its lingering Brexit issues, and the Japanese yen have risen only approximately three per cent. Moving to the Asian region, the China yuan, Australian and New Zealand dollar are all up six per cent. A couple of notable standouts are the Russian ruble and the Brazilian real, both have collapsed around 25 per cent.

Finally, how about our loonie? It’s up only about one per cent in 2020. The Canada-U.S. exchange rate is near the same 77-cent level where we started the year. However, the loonie has broken above its three-year price resistance level as it trades firmly above 77 U.S. cents and a longer-term rally may be emerging. Strong grain prices and good crop basis levels have helped to support farm revenues. Crude oil, which has a big influence on the direction of the loonie, has been sideways over the past six months but is now starting to break out higher.

Turning to the stock markets, the global broad-based World Stock Market Index rose about seven per cent but at one point had plummeted 25 per cent. There was a wide variability of performance between stock markets around the world. Amongst the larger industrialized economic regions, the U.S. is up about 15 per cent and Asia-Pacific markets are up on average about 15 per cent as well. Meanwhile, European is still down six per cent and Latin American stocks markets are down about 15 per cent. The U.K. equity market, of note, is still down around 15 per cent due, in part, to all the Brexit issues. How about Canada? The Toronto Stock Exchange index is up only about three per cent in 2020.

Some industries and sectors have performed better than others. Technology stocks were one of the clear winners this year while energy stocks are still down around 30 per cent. What about the other sectors that got hit really hard and have yet to recover? As of the middle of December, global airline stocks are still down 25 per cent. Cruise line company shares like Carnival Cruise lines and Royal Caribbean, to no surprise, are still down, around 40 per cent. Interestingly enough, retirement or senior living, hotel, office and restaurant real estate investment trusts (REITs) are off only about 10-15 per cent when you factor in the dividends. However, a broad holding of retail and shopping centre REITs are down around 25 per cent for the year, including dividends.

No review of the markets would be complete without a look at interest rates. Government bond rates around the globe touched some amazing lows in 2020. Currently, almost every country in the European Union has negative bond rates and so does Japan. Five-year rates in Canada and the U.S. are still hovering below the half per cent level they’ve been at since the height of the COVID concerns. At the same time, high-yield corporate bond investment rates across North America are now about five per cent. In Canada, our prime lending rate that started the year at four per cent is now 2.5 per cent.

Negative, zero and near-zero government borrowing rates around the world are so low they are almost meaningless. But, in fact, there is a lot of meaning in those low rates. It means things are far from normal. We don’t know exactly how interest rate trends will evolve nor what the consequences will be. While it can’t stay this way forever, this period of low rates could be with us for a long time to come.

Bottom line, the past year has shown once again, in stunning fashion, that periods of great volatility will emerge. However, if you diversify your investments and use business hedging tools like options and futures to help manage risk as well as opportunities, you can more easily navigate these fluctuations.

Don’t expect any big changes as we turn the page on 2020. Regardless of what markets do, you want to have a wide variety of market strategies to manage the ups, the downs and the sideways.

So, it’s onward and upward. All the best in the new year!