* CME feeders find support from lower CBOT corn

* Hog futures narrowly mixed

By Meredith Davis

CHICAGO, Nov 29 (Reuters) - Chicago Mercantile Exchange live

cattle futures closed higher in thin trading on Friday supported

by stronger cash cattle prices, traders said.

Beef packers this week paid $132 per cwt for cattle in the

U.S. Plains, up $1 from last week's trade, feedlot sources said.

U.S. Department of Agriculture data showed some sales at $133

per cwt in Nebraska, up $2 from the previous week.

Cash cattle prices have hovered at or near record levels in

Read Also

Agriculture, including the pork sector, has monsters to slay in 2026

Tariffs, trade protectionism and disruption; Uncertainty is weighing against what should be positive signals for Manitoba’s pork sector.

recent weeks. Longer term cash prices should find support from

the small U.S. cattle herd and high beef prices.

The U.S. Department of Agriculture's Friday morning

wholesale beef price, or boxed beef, was at $202.98 per cwt for

choice cuts, up 43 cents from Wednesday. Select cuts rose 8

cents to $190.28 per cwt. USDA was closed on Thursday's holiday.

"The beef market is on fire. It is going up by leaps and

bounds," said Joe Ocrant, Oak Investment Group president.

The strength in the wholesale beef price is driven by

grocers building up beef inventories after the Thanksgiving

holiday, Ocrant said.

Traders have their eyes on the 6- to 10-day weather forecast

for the U.S. Midwest and Plains regions as extreme cold and

wintry weather is expected there.

"Weather projections look extremely cold. If that is the

case we could see weight come off these animals as they come

into slaughter," said Domenic Varricchio, commodities broker at

Schwieterman, Inc.

Cattle weight gain can slow in cold weather as they eat to

stay warm rather than to gain weight.

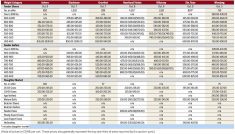

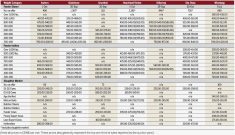

December cattle futures settled up 0.375 cent at

133.475 cents per lb. February cattle settled up 0.150

cent at 134.250 cents.

CME feeder cattle followed live cattle futures higher. Weak

Chicago Board of Trade corn futures also lent support.

January feeder cattle settled up 0.150 cent at

165.475 cents per lb, while March settled up 0.525 cent

at 165.675.

CME livestock futures traded in truncated sessions on

Friday, closing at 12:15 p.m. CST.

CME HOGS END MIXED

CME hog futures settled narrowly mixed in light trading.

Front-month December traded at more than a 4-cent premium to

CME's lean hog index of 80.97 cents which pressured the

contract.

"That index is the biggest weight (on futures), they have to

come together in three weeks," Varricchio said.

Strength in the cash hog market lent some support to hog

futures.

Cash hog prices, as reported by the USDA in the closely

watched Iowa/Minnesota direct market, jumped $3.24 on Friday

morning to $83.24 per cwt.

Hogs in the U.S. Midwest traded steady to $1 higher as

packers booked supplies for next week, hog brokers said.

Some traders anticipate softer cash prices in coming weeks

as record heavy hogs create ample pork in the meat pipeline.

Continued concerns regarding the spread of the Porcine

Epidemic Diarrhea virus (PEDv), a fatal piglet disease, lent

some support to deferred-month hogs. The disease could reduce

hog supplies in 2014.

December hog futures closed down 0.125 cent at

85.675 cents per lb. February hogs closed up 0.100 cent

at 90.575 cents.

(Editing by Bob Burgdorfer)

LIVESTOCK-U.S. live cattle futures end higher on gains in cash

By