* CME feeders follow live cattle higher

* Hog futures supported by firm cash hogs

By Meredith Davis

CHICAGO, Nov 27 (Reuters) - Chicago Mercantile Exchange live

cattle futures rose on Wednesday supported by higher cash cattle

trades this week, analysts and traders said.

Beef packers this week in Kansas paid $132 per cwt, up $1

from last week's trade. Some analysts and traders had expected

steady trade with last week.

"This market has seen a pretty impressive rally given it is

turkey and ham season," said Lane Broadbent, an analyst with KIS

Futures.

The record low U.S. cattle herd continues to boost cash

Read Also

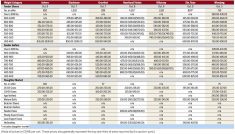

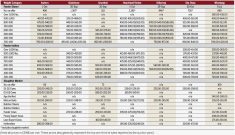

Manitoba cattle prices, Jan. 28

Price ranges for cattle sold at five Manitoba livestock auction markets during the week ending Jan. 27, 2026

prices.

Cattle bought this week will be for post-Thanksgiving beef

production, which was supportive to cash prices as some analysts

expect beef demand to improve after the holiday.

The U.S. Department of Agriculture's Wednesday morning

wholesale beef price, or boxed beef, was higher at $202.75 per

cwt for choice cuts, up $1.33 from Tuesday. Select cuts were up

$1.26 at $190.34 per cwt.

"The higher boxed beef helped the cash cattle market. There

are some expectations that packers are going to need cattle to

meet beef demand before the first of the year," Broadbent said.

Beef processing margins have been squeezed as packers have

paid up for cattle in the cash market. Margins were at a

negative $27.65 per head, compared with a negative $31.70 on

Tuesday and a negative $60.70, according to Hedgersedge.com.

December cattle futures settled up 1.150 cents at

133.100 cents per lb. February cattle settled 134.100,

up 1.075 cents.

CME feeder cattle followed live cattle higher. January

feeder cattle ended 0.950 cent per lb higher at 165.325

cents, while March ended up 0.850 cent at 165.150.

CME HOGS SUPPORTED BY FIRM CASH

Firm cash hog prices helped CME hog futures settle higher in

light trading, traders said.

Hogs in the U.S. Midwest traded steady to $1 higher as

packers built up supplies for a large weekend kill, hog brokers

said.

Packers traditionally plan a large slaughter the weekend

following Thanksgiving day as most plants stop production for

the holiday.

Cash hog prices, as reported by the USDA in the closely

watched Iowa/Minnesota direct market, were not available early

on Wednesday, but prices in the eastern Midwest direct market

rose 88 cents to $77.39 per cwt.

The USDA reported early on Wednesday record high hog weights

in the Iowa/southern Minnesota market for the fourth straight

week. The average weight for the week ended Saturday was 281.4

lbs, up from 281.2 lbs in the previous week and up 7 lbs from a

year earlier.

Deferred month hog contracts were supported by concerns

regarding the spread of the Porcine Epidemic Diarrhea virus

(PEDv), a fatal piglet disease. The disease could reduce hog

supplies in 2014.

December hog futures closed up 0.175 cent at 85.800

cents per lb. February hogs closed up 0.075 cent at

90.475 cents.

CME livestock futures trading will be closed Thursday for

the Thanksgiving Day holiday, and will trade in truncated

sessions Friday, closing at 12:15 p.m. CST.

(Editing by Bob Burgdorfer)

LIVESTOCK-U.S. live cattle futures end higher on cash gains

By