* Live cattle advances lift feeder futures

* CME hogs rise with cash, pork demand optimism

By Theopolis Waters

CHICAGO, May 24 (Reuters) - Chicago Mercantile Exchange live

cattle futures closed higher on Friday aided by short-covering

ahead of the May 25 to May 27 U.S. Memorial Day holiday weekend,

traders and analysts said.

CME live cattle gained 1.0 percent for the week

despite weaker cash cattle and wholesale beef prices.

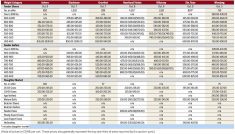

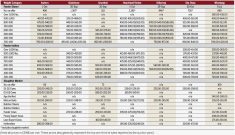

June cattle ended at 120.575 cents, 1.450 cents per

lb higher, and August ended up 1.025 cents at 119.225

cents.

"It was quiet before the holiday with short-covering the

Read Also

Biosecurity during calving: What’s your farm’s risk?

Cow-calf producers in Western Canada should have a well-designed biosecurity plan during calving season to reduce disease risks to the cattle herd.

main feature," a trader said.

"This week's disappointing cash trade is behind us, so

people are going to see what's next for cash after they return

Tuesday from their vacations," he said.

Cash cattle this week fetched $124 to $125.50 per

hundredweight, compared with $124 to $126.50 last week, feedlot

sources said.

U.S. Department of Agriculture data on Friday morning

quoted the wholesale price of choice beef, or cutout, down $1.44

per hundredweight at $209.93 per cwt. It dropped below

Thursday's fresh record high of $211.37.

Packers needed fewer cattle, with plants scheduled to be

closed on Monday for the holiday. And grocers are not expected

to book more meat until they determine how much product moved

during the three-day holiday weekend.

Next week, processors may raise cash cattle bids while

buying animals for the following week - the first full slaughter

week after the holiday, analysts and traders said.

CME feeder cattle rose on pre-holiday short-covering and the

higher live cattle market.

Feeder cattle futures for the week finished up 7.9

percent. It was their biggest weekly increase since the week

ended May 3, 1996, at 10.7 percent.

This week's percentage change seems large after May futures

expired on Thursday at 131.625 cents, which was a sizable

discount to the new lead month August, a trader said.

August settled at 144.550 cents, up 1.900 cents, and

September finished 1.725 cents higher at 146.675 cents.

HOGS UP WITH CASH HOPE

CME hogs climbed in anticipation of higher cash hog and

wholesale pork prices following Monday's holiday, traders and

analysts said.

Processors will need more hogs to accommodate what is

expected to be a big Saturday slaughter to make up for Monday's

holiday downtime, a trader said.

And high-priced beef may prompt some shoppers to switch to

relatively inexpensive pork, he said.

The government's Friday afternoon mandatory wholesale pork

price, or cutout, calculated on a plant-delivered basis was

$94.42 per hundredweight, up 14 cents from Thursday.

Friday afternoon's USDA data showed the average hog price in

the most-watched Iowa/Minnesota market at $90.21 per

hundredweight, down 11 cents from Thursday.

CME lean hogs ended up 3.6 percent for the week.

June closed 0.675 cents per lb higher at 94.875

cents and July ended at 93.300 cents, up 0.275 cent.

(Reporting by Theopolis Waters; Editing by Peter Galloway)

LIVESTOCK-Short-covering rallies US live cattle before holiday

By