* Weak corn prices support CME feeder cattle

* Short-covering props up CME hog futures

By Meredith Davis

CHICAGO, Nov 15 (Reuters) - Chicago Mercantile Exchange live

cattle futures ended firmer on Friday, helped by higher cash

prices, traders said.

Packers in Texas and Kansas paid $132 per cwt on Friday for

cash or slaughter-ready cattle, $1 higher than last week,

feedlot sources said.

Generally tight cattle supplies in the near term and recent

futures advances were supportive cash cattle factors, traders

and analysts said.

"The (live cattle) futures felt like it wanted to go down

Read Also

Scientists discover cause of pig ear necrosis

A University of Saskatchewan team, through years of research, has discovered new information about pig ear necrosis and what hog farmers can do to control it.

but then the cash trade came out and propped it up," an a trader

said.

Processors were reluctant to overpay for supplies given

their poor operating margins and lackluster wholesale beef

demand.

The U.S. Department of Agriculture reported Friday

afternoon's choice beef wholesale price at $201.16 per cwt, down

$1.40 from Thursday. That price was the lowest since $200.97 on

Oct. 25.

The National Beef packing plant in Liberal,

Kansas, shut down operations on Thursday and Friday for

mechanical repairs, but plans to reopen on Saturday, a company

spokesman told Reuters on Friday.

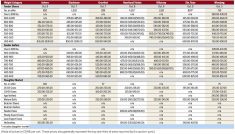

CME live cattle December finished up 0.425 cent per

lb at 133.400 cents, and February closed at 134.800

cents, up 0.275 cent.

Feeder cattle futures moved up with CME live cattle futures

and as corn prices drifted lower.

November feeders closed up 0.125 cent at 165.150

cents per lb, and January ended at 165.825 cents, 0.625

cent higher on the day.

HOGS RISE DESPITE LOWER CASH PRICES

Short-covering following three straight days of market

losses pushed up CME hogs, traders and analysts said.

Futures gained despite the pullback in cash hog and

wholesale pork prices amid abundant supplies at record-high

weights, traders said.

Cooler fall temperatures and less-expensive newly harvested

corn is allowing hogs to put on weight quickly.

"Until we see some signs of the weights coming down it will

be hard to see a sustained futures rally. The packers don't need

to chase hogs," said independent livestock futures trader Dan

Norcini.

Friday afternoon's cash hog prices in the closely watched

Iowa/Minnesota market were at $79.58 per cwt, down 40 cents from

Thursday, USDA said.

The government's Friday afternoon wholesale pork price for

pork dropped $2.00 per cwt from Thursday to $91.97 per cwt,

following a $7.35 plunge in costs for pork bellies, which are

made into bacon.

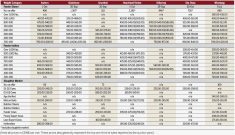

December hogs ended up 0.300 cent at 85.900 cents

per lb, while February closed up 0.475 cent at 90.275

cents.

(Editing by G Crosse)

LIVESTOCK-Higher cash prices lift U.S. live cattle futures

By