* CME feeder finish down sharply

* Hog futures close narrowly mixed

By Meredith Davis

CHICAGO, Nov 19 (Reuters) - Chicago Mercantile Exchange live

cattle futures ended lower on Tuesday, pressured by technical

selling and weaker wholesale beef prices, analysts and traders

said.

As the Thanksgiving holiday season approaches beef demand

typically diminishes in favor of turkey and ham. Analysts said

less demand may cause a backlog of beef products, which could

drive wholesale prices even lower.

The U.S. Department of Agriculture Tuesday morning reported

the choice beef wholesale price at $199.88 per cwt, down 68

Read Also

Biosecurity during calving: What’s your farm’s risk?

Cow-calf producers in Western Canada should have a well-designed biosecurity plan during calving season to reduce disease risks to the cattle herd.

cents from Monday. Select cuts slid 47 cents to $189.24.

"There is the issue of demand on the beef side of the

equation. A lot of skeptics say that you can't move beef at

these levels," said Dan Norcini, an independent livestock

futures trader.

Investors are uncertain about this week's cash cattle price

direction following live cattle futures' recent selloff and as

packer margins slipped deeper into the red.

There were no cash cattle bids or offers reported early on

Tuesday, according to feedlot sources. Cash-basis cattle last

week moved at $132 per cwt.

The USDA suspended its semi-annual U.S. cattle inventory

report for a second year on Tuesday due to budget cuts.

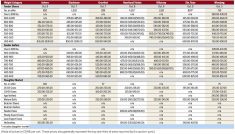

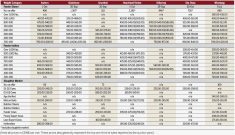

Live cattle December finished down 0.950 cent per lb

at 130.950 cents, and February closed at 131.675 cents,

or 1.525 cents lower.

CME feeder cattle fell, led by fund liquidation and lower

live cattle futures.

November feeders, which will expire on Nov. 22,

closed down 0.475 cent at 164.375 cents per lb. January

ended at 162.400 cents, 1.900 cents lower.

HOGS END MIXED

CME hogs ended narrowly mixed, pressured by lower wholesale

pork values while the rebound in cash hog prices offered

support, traders and analysts said.

Some packers raised cash bids to ensure they have supplies

for the rest of this week's production.

Tuesday morning's cash hog prices in the closely watched

Iowa/Minnesota market jumped $3.30 per cwt to $81.51, the USDA

said.

Increased hog numbers at heavier weights dragged on

wholesale pork prices, Norcini said.

The government's Tuesday morning wholesale pork price fell

$1.25 from Monday to $91.43 per cwt.

Packers on Monday and Tuesday processed 876,000 hogs, 46,000

more than a week ago and up 8,000 from a year ago for the same

period, based on USDA estimates.

December hogs settled down 0.175 cent at 85.425

cents per lb, while February closed unchanged at 89.900

cents. April finished up 0.450 cent to 92.750 cents.

(Editing by Meredith Mazzilli)

LIVESTOCK-CME live cattle futures decline on technical selling

By