Cattle auctions in Manitoba saw some good strength during the week ended March 24, as rising U.S. futures provided underlying support.

“The (U.S.) futures board’s been climbing, which is certainly helping drive demand,” said Allan Munroe of Killarney Auction Mart.

Both the feeder and finished cattle futures at the Chicago Mercantile Exchange climbed higher during the week, as chart-based buying added to the generally favourable fundamentals of tight supplies, good demand and profitable packer margins.

Relative weakness in the Canadian dollar compared to its U.S. counterpart remained supportive for the local market as well, with more U.S. buying interest noted in recent weeks, according to Munroe. Plenty of cattle were also still moving east and west, he added.

Read Also

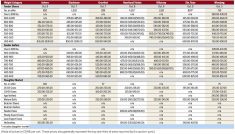

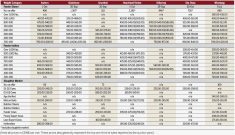

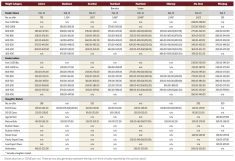

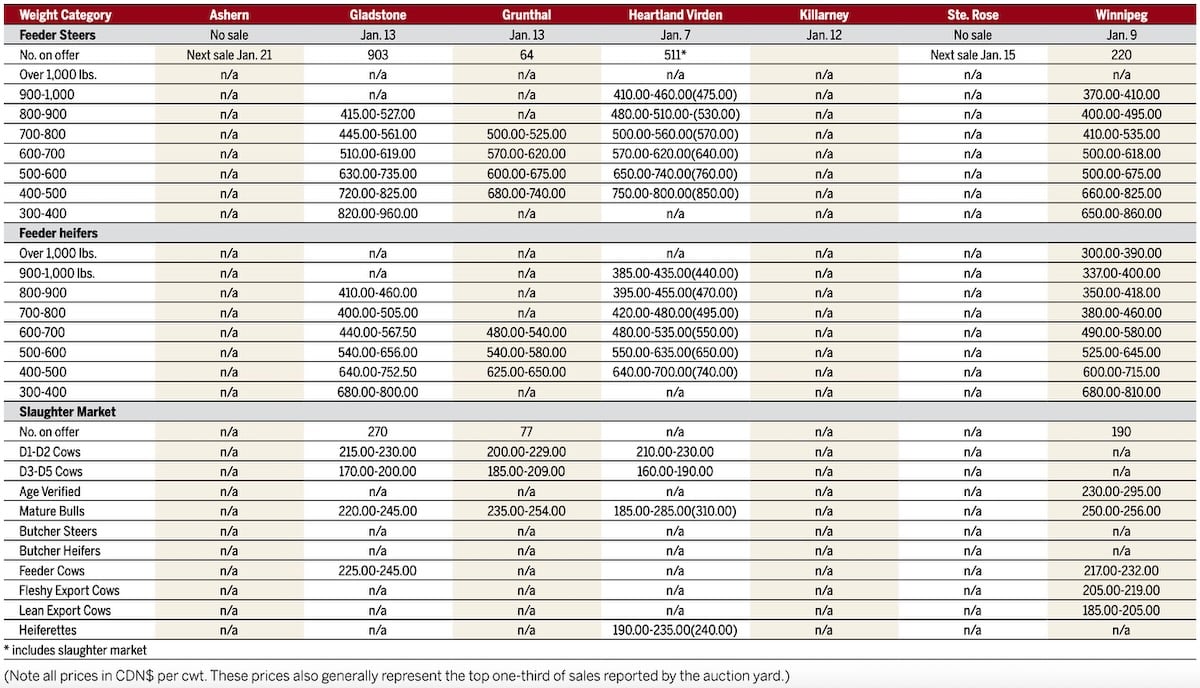

Manitoba cattle prices, Jan. 15

“Every analyst I was listening to all winter said ‘(Prices) will keep going lower and lower,’ but they have just been going higher and higher,” he said.

Carcass weights have dropped significantly over the past year, which Munroe linked as a supportive influence in the futures.

“It’s back up to the point where people are very pleasantly surprised with what their calves bring,” Munroe said of the current feeder market. He expected the favourable prices would keep cattle coming to market over the next few weeks, but expected the numbers would soon dwindle as attention turns to spring field work and calving.

“The two basic drivers for selling cattle are cash flow and pen space, and we’re getting closer to calving and the pen space issue,” said Munroe.

“When numbers start to drop, it will make it tougher for the east guys to put loads together,” he said, and expected that would lead to strong demand from those who do show up.

On the butcher side, “cows really took a move this week,” said Munroe, pointing to strong butcher cattle demand and prices. Packer buyers were aggressive, he said, while seasonal barbecue demand may also be starting to come forward.

News that Brazilian meat imports were being banned from a number of countries, due to a scandal over tainted food, provided spillover support for the Canadian market.

“If they get shut out of a place that we don’t directly ship to, one of our competitors is shipping there and that opens up somewhere else,” said Munroe.

However, the situation with Brazil appeared to be cleared up by the end of the week, with a number of markets announcing they would once again accept Brazilian meat.