The slow pace of Canadian canola exports is an ongoing issue, with lack of offshore movement a heavy weight on the market. However, the crop may finally find traction on the export front.

AAFC projections: Agriculture and Agri-Food Canada released updated supply/demand tables May 21, cutting its call for 2023-24 canola exports to six million tonnes, which compares with an earlier forecast of seven million. The government agency also lowered its call on 2024-25 exports by 800,000 tonnes to 6.9 million.

USDA numbers: It’s in the new crop where canola exports should increase. The United States Department of Agriculture also forecasts Canadian exports of 6.9 million tonnes in 2024-25 but predicts larger production and domestic use than AAFC. The USDA expects Canada to grow 19 million tonnes of canola in 2024-25.

Read Also

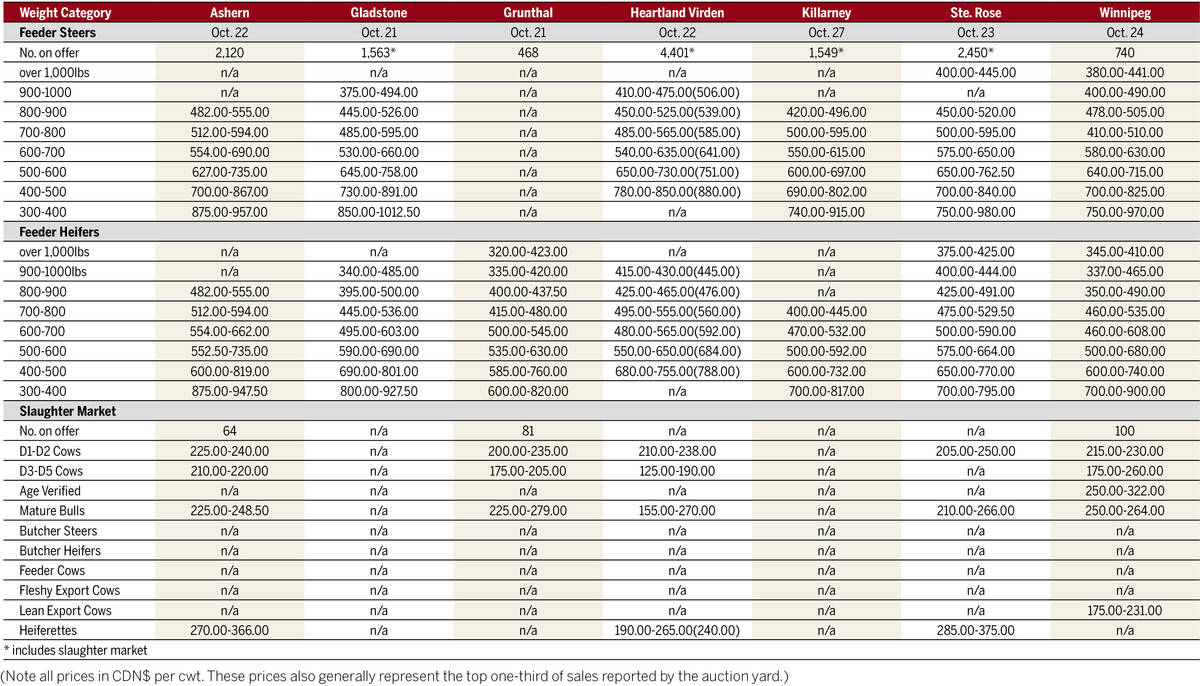

Manitoba cattle prices – Oct. 28

Local cattle sale prices from Manitoba’s seven cattle auctions for the week of Oct. 14 to 21, 2025.

Europe: Europe is not a typical destination for Canadian canola, but price adjustments over the past few months could open that door. The November rapeseed contract on the Euronext platform moved from a low of 414 euros per tonne in mid-February to 500 euros by May 23. Factoring in the exchange rate, that represents an increase of about $140 per tonne, with the November rapeseed contract trading at around $740 per tonne in late May. Canadian canola traded at roughly even money to European rapeseed when both commodities were at their lows, but now finds itself at a $45 per tonne discount.

Ukraine: Ukraine would normally be a likely candidate to fill any shortfalls. However, the ongoing war and recent frosts have hurt Ukraine’s crop. The latest estimates show production of only 4.1 million tonnes.

China: China is the constant wildcard when it comes to demand. While canola prices may be trending higher, Canadian canola is more attractively priced compared to other global oilseeds.