ICE Futures canola contracts lost roughly $150 per tonne over the past two months, as speculators put on large short positions and exaggerated the seasonal harvest pressure.

Values hit fresh four-month lows as the calendar flipped to November, but the market was also showing signs of a possible corrective bounce.

The most active January contract traded below the key $680 per tonne chart level on several occasions, hitting a session low of $672 on Nov. 2 before recovering back above $690 at the time of this writing on Nov. 3.

Read Also

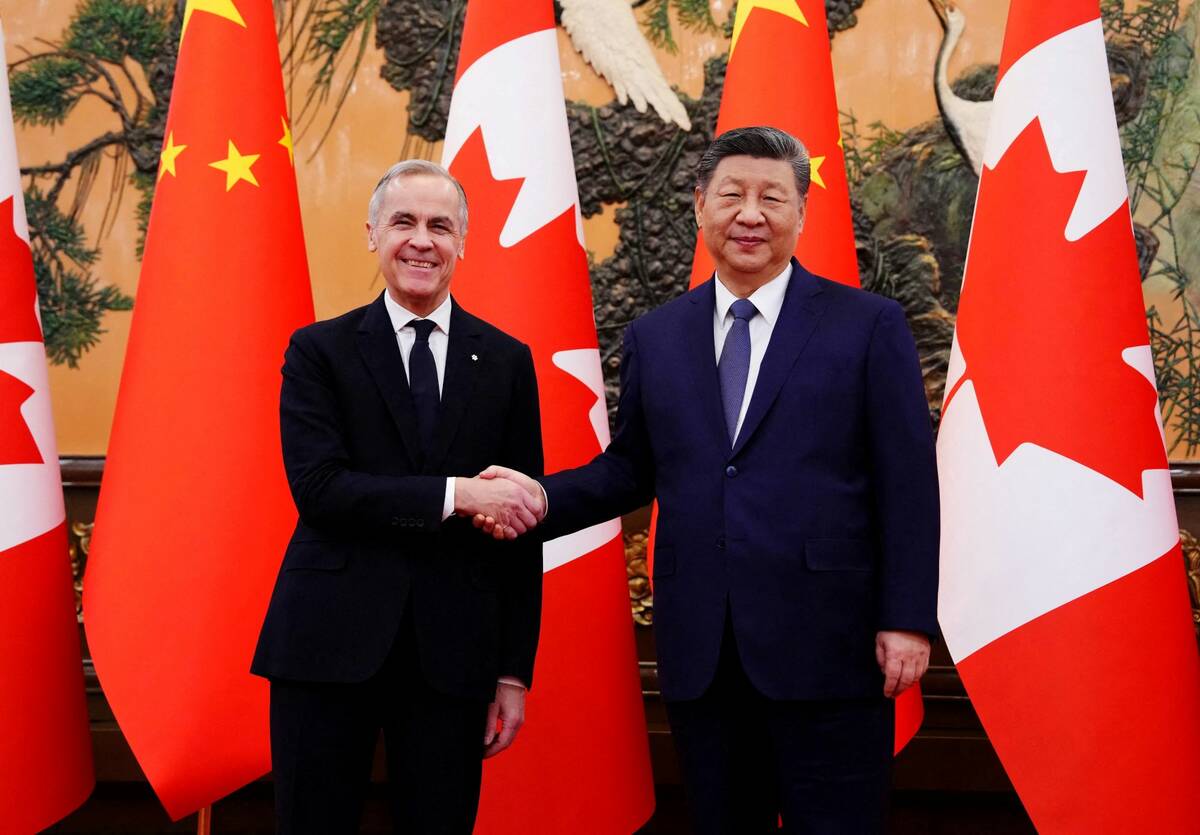

Pragmatism prevails for farmers in Canada-China trade talks

Canada’s trade concessions from China is a good news story for Canadian farmers, even if the U.S. Trump administration may not like it.

The major trend lines still pointed down, but with harvest complete and attention turning to outside influences, the market may be due for a period of consolidation.

The net speculative short position in the ICE Futures canola market rose to its largest level ever recorded in late October, as fund traders put on fresh bearish bets and liquidated previously placed long positions, according to data from the U.S. Commodity Futures Trading Commission’s Commitments of Traders.

As of Oct. 24, the net managed money short position in canola futures came in at 93,603 contracts (6,745 long, 100,348 short), nearly 20,000 contracts above the previous record.

Such a large speculative position can easily sway a relatively lightly traded market such as canola. Depending on where they think the market is going, those spec traders could pressure values lower in an attempt to make their short positions more profitable, or they could just as easily contribute to a rally whenever they decide to buy back those shorts.

A close above $700 per tonne in the January contract would be one chart signal of a shift in sentiment for canola, with the next upside target coming in around the $720 per tonne area. However, if the correction fails to hold, a retreat to the $650 area remains possible.

The Canadian canola market has generally taken direction from Chicago soyoil, with the charts for the two commodities following similar patterns over the past few months. Soymeal hit contract highs in late October, leaving soybeans themselves rangebound.

Concerns over reduced production out of Argentina, the world’s largest soymeal exporter, accounted for some of the recent strength in soymeal. However, recent rains in the South American country have alleviated some of those concerns, allowing the oil/meal spreads to narrow.

Canola has a much larger oil content than soybeans, and there is a case to be made that world vegetable oil supplies will tighten over the next year.

Canola crush margins are already historically wide and domestic processors show good demand. However, larger oilseed exports from the Black Sea region have tempered demand for canola on the export front, leading to a situation in the countryside of much better basis levels from domestic processors compared to export-oriented line companies.

Domestic disappearance for canola was running ahead of the year ago level, at 2.6 million tonnes through 13 weeks, according to the latest Canadian Grain Commission data. Exports of about 1.6 million tonnes are on par with the 2022-23 pace, but are expected to ease.