Beef cattle

Must Reads

-

Good handling equipment a must on cattle operations

For the safety of cattle producers and everyone else dealing with their livestock, including veterinarians who need animals to be…

-

-

Consumers say they would purchase pork from gene-edited pigs

A new eight-country study shows more than 90 per cent of consumers are open to purchasing pork from gene-edited pigs…

-

-

Manitoba tick study focuses on testing, other carriers for anaplasmosis

Manitoba research explores anaplasmosis transmission from ticks and, maybe, flies, as well as laying hopeful groundwork for a better test…

-

The end of a parasite control era in livestock

The age of the one-stop parasite treatment is slipping. Treating internal parasites, as well as external pests like lice, is…

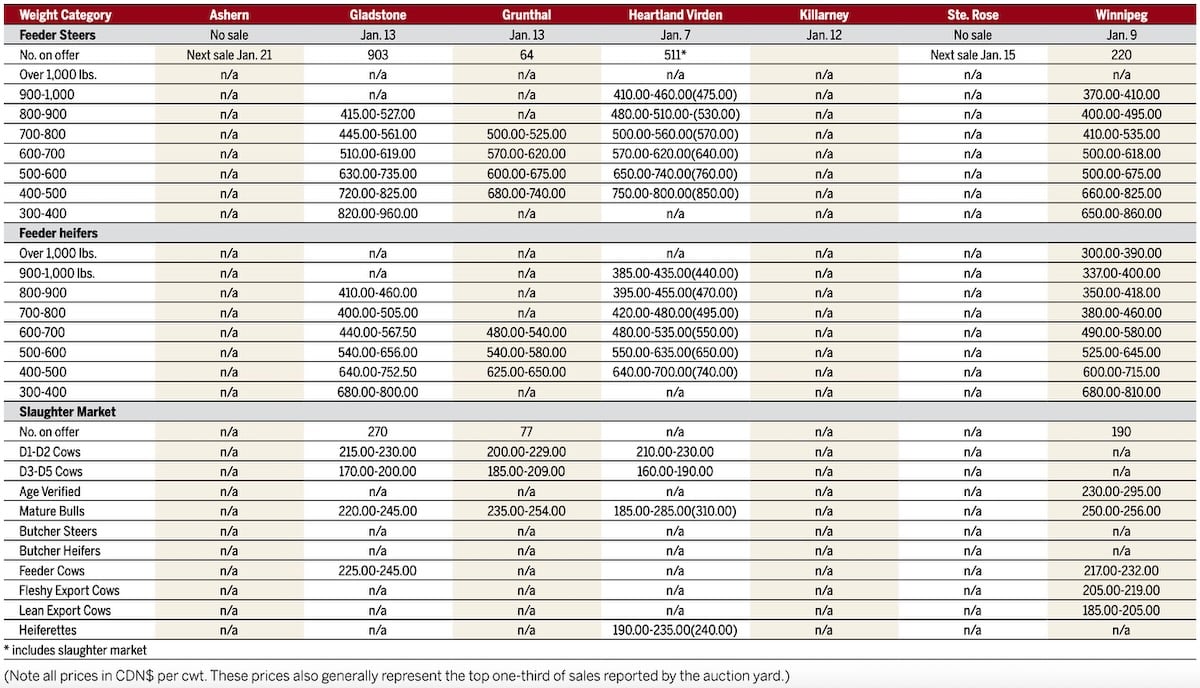

Manitoba cattle prices, Jan. 28

Price ranges from five Manitoba auction markets during the week ending Jan. 27, 2026

Price ranges for cattle sold at five Manitoba livestock auction markets during the week ending Jan. 27, 2026

Klassen: Western Canadian calf prices ratchet higher

For the week ending January 24, Western Canadian feeder cattle markets traded $10/cwt lower to $10/cwt higher compared to seven days earlier. The market was quite variable depending on flesh conditions and genetic quality. Prices for backgrounded yearlings or fall placed calves were steady to $5 higher on larger packages on controlled weight gain diets;

U.S. livestock: Cattle futures end week higher

Cattle futures on the Chicago Mercantile Exchange were stronger on Friday, with positioning ahead of a major winter storm set to move through the United States providing support.

U.S. livestock: Cattle steady ahead of feed report

Cattle futures on the Chicago Mercantile Exchange held close to unchanged on Thursday, with the bias lower in the most active months.

Canadian beef could be headed to China by next week says Agriculture Minister

The Canadian Cattle Association (CCA) says the Chinese market will re-open to Canadian beef — though details are still scant.

Klassen: Feeder market near historical highs

For the week ending January 17, Western Canadian feeder cattle markets traded $5/cwt lower to $10/cwt higher compared to the week ending January 10. The market was quite variable across the Prairies with weather conditions influencing the price structure. Overall, there was very strong demand with Ontario and Southern Alberta feedlots aggressively working to secure

U.S. livestock: Cattle futures drop Friday

Cattle futures on the Chicago Mercantile Exchange fell from nearby highs Friday, with profit-taking to end the week weighing on values. U.S. markets will be closed Monday for Martin Luther King Jr. Day.

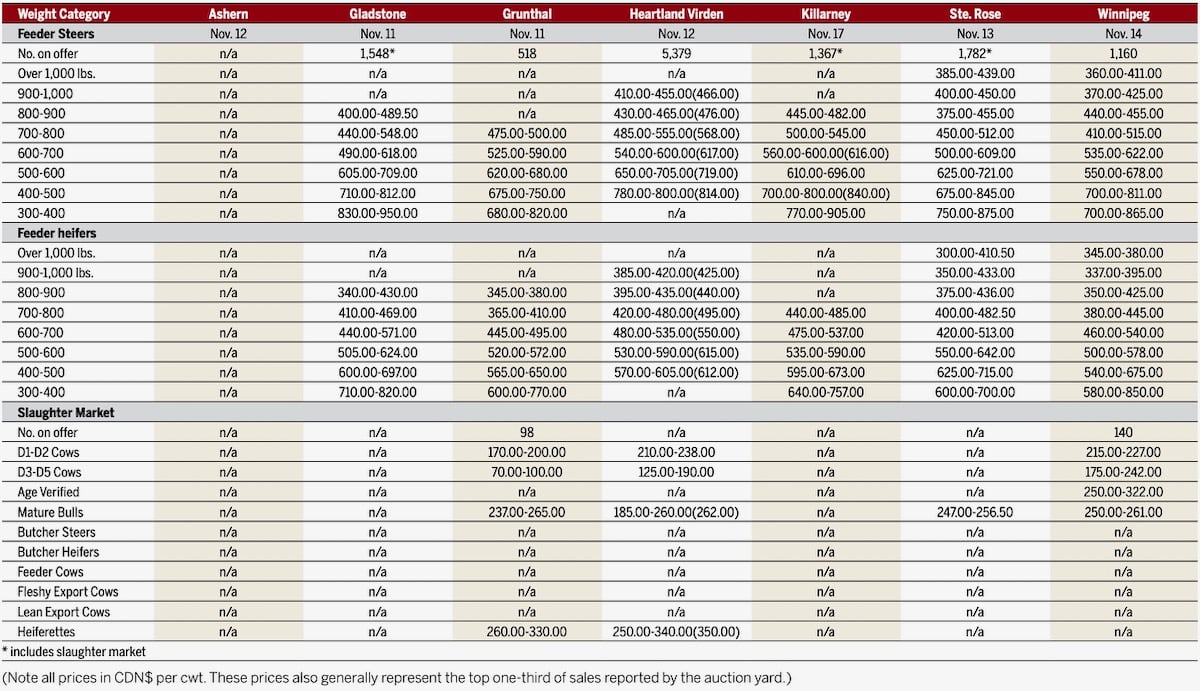

Manitoba cattle prices, Jan. 15

Regular livestock auctions have resumed in much of Manitoba after the holidays

Klassen: Feeder market poised to strengthen

There were no feeder cattle sales in Western Canada for the week ending January 3. However, there were some sales in the U.S. and the Canadian markets will follow suit once activity returns to normal. For example, at the Ozarks Regional Stockyards in West Plains, Missouri, weaned and vaccinated steers and heifers over 750 pounds

Klassen: Feedlot margins will determine feeder prices

There were no Western Canadian feeder cattle sales for week ending December 27. The shortened holiday week is always a time for cattle producers to call in and discuss factors that will influence the feeder market over the next couple months. In the short-term, finishing feedlot margins are the main factor driving the feeder market.