Does the size of your farm impact how risky you are for crop insurance?

According to the data, the answer is yes.

That was among the insights from David Van Deynze, chief product officer with Manitoba Agricultural Services Corporation (MASC), as he took the stage during the opening day of Manitoba Ag Days 2026.

WHY IT MATTERS: Manitoba Ag Days is again drawing crowds Jan. 20-22 at Brandon’s Keystone Centre.

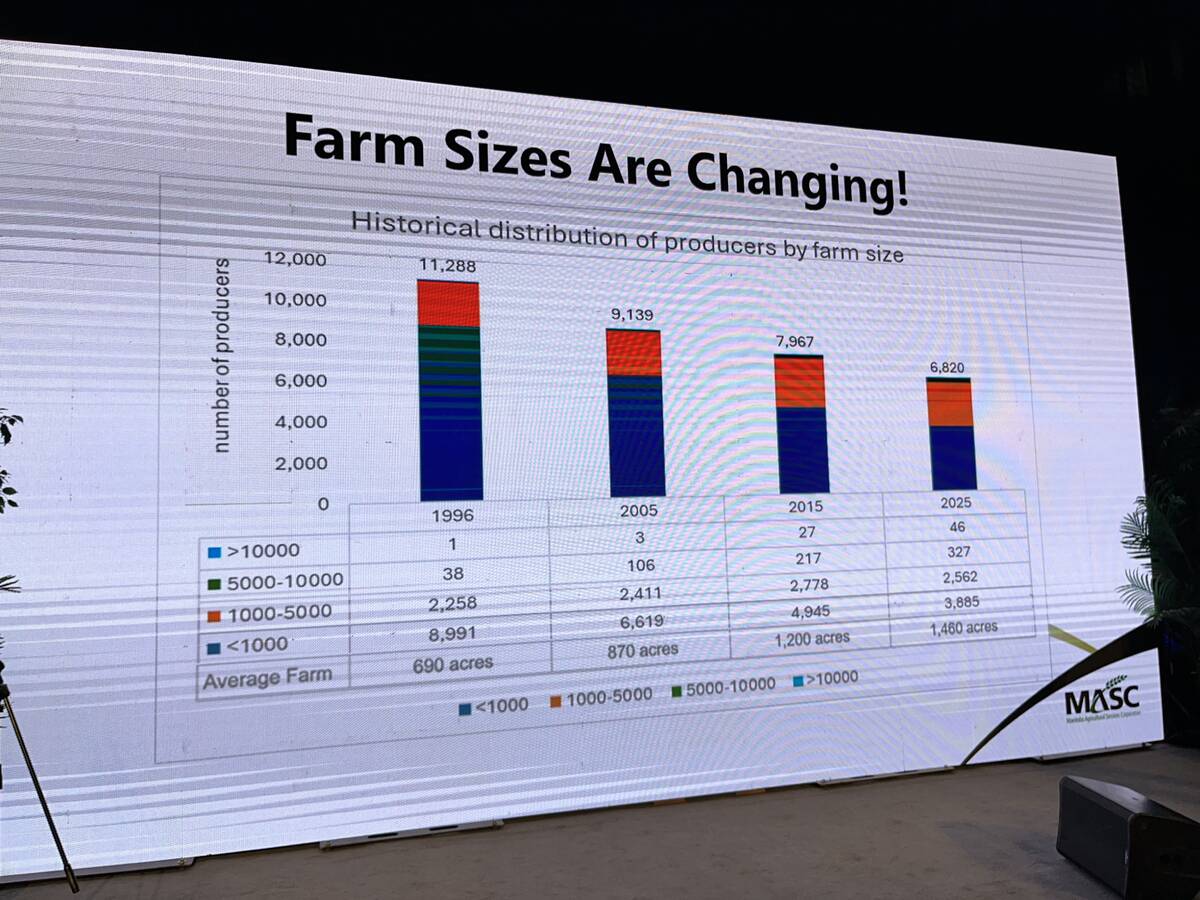

MASC’s data backs up the now-common idea that farm sizes have been shifting on the Prairies in recent decades. In 1996, the average size of a farm insured by MASC was 690 acres. Last year, it was 1,460 acres.

The Crown corporation looked at insured farms from 2003-2024. Dividing farm categories by size, and then looking at the frequency of claims per size category, there’s a sweet spot where claim frequency drops, Van Deynze noted. Farms under 500 acres and over 7,500 acres both had higher claim frequencies. That dropped in farms between 500-1,500 acres, and again for farms 1,500-3,000 acres and 3,000-4,500 acres, before starting to rise again in larger size categories.

“Of course, insurance programs don’t always look at exactly how many claims they have,” Van Deynze said. “What probably is more meaningful is how big are those claims? How much money are they collecting from the insurance program relative to the coverage that we’re offering?”

On that front, small farms under 500 acres also had a much higher loss-to-coverage ratio (0.124), MASC data showed. That ratio dropped significantly for the larger farms. Even 500- to 1,500-acre farms saw the ratio drop to 0.086. The trend largely continued down as farms got bigger, hitting a plateau of 0.059 at 3,000 acres, and rising slightly again for farms 6,000-7,500 acres (0.061). Farms 7,500 acres and larger had an LCR of 0.058.

“Whether you’re a 3,000-acre farm or bigger-than-7,500-acre farm, your loss ratio is essentially the same,” Van Deynze said.

MASC data also showed benefits on crop diversity (more crop groups in the rotation showed a steady drop in LCR).

Does that mean you should get a break on your premiums for a larger, more diverse farm?

Not directly, Van Deynze said. Instead, the relative lack of claims seen by certain farms will start to play out in their premiums through the basic process of crop insurance calculation.

For more Manitoba Ag Days coverage, watch the Co-operator’s Ag Days landing page.