MarketsFarm — Durum bids in Western Canada are holding relatively steady, with prices only seeing small moves over the past month despite larger swings in spring wheat. Durum prices in southern Saskatchewan have traded in the $235-$243 per tonne area over the past month, a relatively narrow $8 trading range compared to Canada Western Red

Durum market holds steady despite spring wheat swings

Canola funds still short, despite active U.S. covering

MarketsFarm — Speculators continue to sit on a large net short position in ICE canola futures, only reducing their holdings slightly in late May, according to the latest commitment of traders (CoT) report from the U.S. Commodity Futures Trading Commission (CFTC). Managed money and other reportable speculators had a net short position of 71,065 contracts

U.S. cattle supplies, corn futures may drag on prices

Local cattle values are still reasonably steady for now

Activity at Manitoba’s cattle auction yards is slowing down ahead of the summer, with the Victoria Day weekend also limiting some of the activity during the week ended May 24. Prices held reasonably steady for the most part, although outside market influences may keep some caution in the Canadian cattle sector over the next few

ICE weekly outlook: Uncertain U.S. soy prospects boost canola

MarketsFarm — ICE Futures canola contracts climbed sharply higher during the week ended Wednesday, hitting their best levels in more than a month as strength in the Chicago Board of Trade soy complex provided spillover support. “We have a bit of a short-covering rally going on in canola,” said Jerry Klassen, manager of Canadian operations

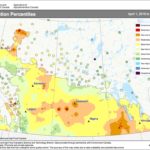

Prairie dryness concerns to persist

MarketsFarm — Large areas of Western Canada remain on the dry side, with little moisture in the immediate forecasts. And while it’s still early in the growing season, the interplay of conflicting patterns from the south and north will determine whether the dry areas receive timely precipitation during the growing season. “We are looking at

Fund traders still sitting on large canola short position

MarketsFarm — Speculators continue to sit on a large net short position in ICE canola futures, only reducing their holdings slightly over the past week, according to the latest commitment of traders (CoT) report from the U.S. Commodity Futures Trading Commission (CFTC). Managed money and other reportable speculators had a net short position of 72,844

Pressures on soybean market put crunch on canola values

China trade troubles outweigh concerns about late planting

ICE Futures canola contracts moved higher for most of the week ended May 17 before running into resistance, as the Canadian oilseed reacted to activity in the Chicago soybean complex. The July contract has improved by roughly $20 per tonne off of its early-May lows over the past two weeks, and saw additional strength when

Huge increase predicted in canola ending stocks

MarketsFarm — Canadian canola carryout stocks are forecast to rise to a record 5.3 million tonnes by the end of the 2019-20 marketing year, more than doubling the previous five-year average, according to updated estimates from Agriculture and Agri-Food Canada’s market analysis division. While the department, in its estimates, expects total canola production to decline

CWRS bids hold steady on Prairies, other classes drop

MGEX July wheat was up on the week while CBOT and K.C. July wheat slipped

Canada Western Red Spring (CWRS) wheat bids held relatively steady during the week ended May 10, as the Minneapolis futures managed to edge higher on the week despite losses in the Chicago and Kansas City winter wheat markets. Average CWRS (13.5 per cent protein) wheat prices were held within $1 per tonne of unchanged at

ICE weekly outlook: Canola looking for more support

MarketsFarm — ICE canola futures moved higher during the week ended Wednesday as a rally in the Chicago Board of Trade soy complex provided support. Whether there’s more room to the upside remains to be seen. “It looks like we’ve maybe turned a corner,” said Wayne Palmer, senior market analyst with Exceed Grain in Winnipeg.