Recent rains in Manitoba have greened up pastures and in turn slowed down the number of cattle headed to market, said Kirk Kiesman, manager at Ashern Auction Mart. In light of the severe drought on the Prairies, and especially in the Interlake region of Manitoba, the Ashern market organized a number of auctions this summer.

Recent rain slows cattle rush at Manitoba auction markets

Feeder cattle and calves show price strength

ICE weekly outlook: Canola futures slide, cash prices might not follow

Weakness seen ongoing in soy complex

MarketsFarm — If the October soyoil contract on the Chicago Board of Trade (CBOT) falls to 55 U.S. cents/lb., it’s likely ICE Futures canola will drop to around $850 per tonne, according to analyst Errol Anderson of ProMarket Communications in Calgary. ICE November canola closed Wednesday at $890.80 per tonne, giving up $10.80 since the

Feed weekly outlook: No surprises in latest barley numbers

MarketsFarm — Following the release of monthly supply and demand estimates from Agriculture and Agri-Food Canada (AAFC) Thursday, Brandon Motz of CorNine Commodities at Lacombe, Alta. wasn’t surprised at how low the numbers dropped, particularly for barley. Motz commented the harvest hasn’t been as good as initially thought, noting the AAFC report confirmed the situation

Canola remains the follower

Prices still must reflect that there won’t be enough canola to go around

Canola futures took a tumble at the end of this week as prices on the Chicago soy complex pulled back, with declines in European rapeseed and Malaysian palm oil adding to the mix. The Canadian oilseed demonstrated some independent strength as price rationing propelled values higher earlier in the week, but weakness in the other

CBOT weekly outlook: Factors worth watching

Oats showing recent strength

MarketsFarm — Choppiness in Chicago Board of Trade (CBOT) soyoil, a potential increase in corn prices and an upcoming production report from Statistics Canada are factors on which grains analyst Terry Reilly suggests keeping an eye. Soyoil has been hit by early reports that the U.S. Environmental Protection Agency was going to recommend to the

Pulse weekly outlook: Lentils up on lower production, stronger demand

MarketsFarm — As with so many other crops on the Prairies, production of lentils will be lower this year due to the drought. However, MarketsFarm Pro senior analyst Mike Jubinville said the lentil crop likely fared a bit better than cereals or oilseeds. Earlier this year, Statistics Canada projected lentil production to come at about

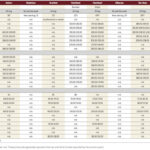

Prairie cash wheat: Big jump for durum

U.S. futures, lower loonie supportive for cash wheat bids

MarketsFarm — Wheat bids in Western Canada for the week ended Thursday were higher for Canada Western Red Spring (CWRS) and Canada Prairie Spring Red (CPSR) wheats, while there were sharp increases for Canada Western Amber Durum (CWAD). Gains in U.S. wheat markets supported values, as did a steep drop for the Canadian dollar. Average

ICE weekly outlook: Canola remains expensive

MarketsFarm — Concerns over the likelihood of a much smaller canola crop than previously anticipated, coupled with a very tight supply situation, continued to underpin values this week. That price rationing in turn has kept canola more expensive than other edible oils, according to trader Keith Ferley of RBC Dominion Securities in Winnipeg. “The market

ICE weekly outlook: Something of a tough week for canola

MarketsFarm – It was a bit of a tough week for canola on the Intercontinental Exchange (ICE), although there was something of a bright spot after the release of the August supply and demand estimates from the United States Department of Agriculture (USDA). As one trader put it, canola did its job by increasing in

ICE weekly outlook: Major canola supply issues ahead

MarketsFarm – There’s a looming problem that’s on the verge of surfacing in the Canadian canola market – many growers will be unable to fulfill their contracts due to lower production. The drought across the Prairies dashed canola production estimates from the initially anticipated 20 million tonnes, to something that could be in the range