Canola yields not great, but good improvement

Harvest progress last week was well behind the five-year pace

CBOT weekly outlook: War chatter part of market chaos

Stronger U.S. dollar weighs on futures

La Nina set to continue for third year

Other weather patterns may override temporarily

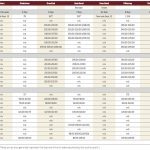

Cattle trickle in, but soon to rise sharply

Heavy feeder steers and heifers show price improvements on the week

StatCan’s canola call in line with expectations

Agency also boosts wheat projection

Canola falls back

Flagging fortunes for crude and vegetable oils alike have added pressure

CBOT weekly outlook: More acres, smaller yields anticipated in U.S.

Prairies’ high-pressure ridge should give way by mid-month

Brisk harvest pace expected meanwhile

Canola prices rangebound at start of harvest