Virtually no support for canola values

FUTURES | Vegetable oils and crude oil seem to have gone separate ways

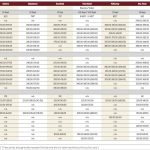

Feed weekly outlook: Barley bids near bottom post-harvest

Feed corn values narrowing against barley

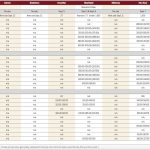

Pulse weekly outlook: India dispute leaves lentils’ future uncertain

India was Canada's top customer in 2022-23

Slaughter cattle prices dip ahead of fall run

Cow prices expected to drop, but feeder cattle and calves more hopeful

ICE weekly outlook: Which way will canola go?

Basis levels have recently improved

Beef sector faces weather, insurance challenges

Prices have been a boon, but other problems remain

CBOT weekly outlook: Prices for U.S. soybeans, corn where they should be

USDA report calls for tightest soy carryout in eight years

StatCan expected to raise estimate for oats production

Ending stocks estimate 'probably fairly accurate'

Prairie cash wheat: Prices for reds rise, amber eases back

Harvest pressure, Canadian dollar also factors

Feed weekly outlook: Harvest pressure keeps lid on prices

Domestic prices seen weighing on corn imports