Brazil’s second corn crop facing delays

Acres either too dry or too wet for planting

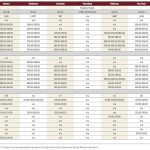

Prairie cash wheat: Weaker U.S. values pull down Canadian prices

Lower export sales drag on U.S. wheat

Feed weekly outlook: Prices to continue slipping back

Feedlots covered for now

It wasn’t a good week for canola prices

The soy complex drags on canola values

Oat cash prices don’t immediately follow CBOT movement

One trader can push market around, trader says

Pulse weekly outlook: Lentils shift in narrow range

Farmers seen sitting on product for now

Cattle prices dip but remain far stronger than a year ago

Chicago futures seen grinding lower

ICE weekly outlook: Canola pulling lower

Futures subject to 'financial gravity'

CBOT weekly outlook: Corn rangebound, soybeans rising, wheat erratic

Chicago wheat fluctuation 'just drives you nuts'

CBOT weekly outlook: Harvest pressure weighing on prices

'No heavy concerns about supply in general'