Cracked crystal balls abound

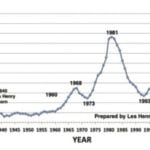

Predictions have a funny way of turning out spectacularly wrong

Fall harvest showed little market impact

A tough fall usually has little effect on harvest or prices in the end

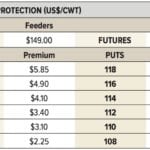

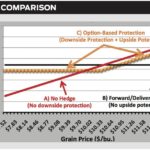

The ABCs of cattle options and futures

These tools can help you manage both your costs and your revenue

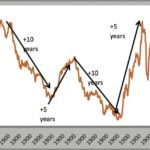

Risk and volatility not necessarily same

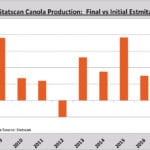

Hedging Your Bets: Current canola and farmland prices are examples of markets at risk of a sudden change

Paved with good intentions

Early production estimates start with seeding intentions, which may or may not materialize

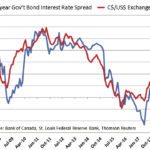

Don’t let currencies drive you ‘loonie’

There are a few practical ways to look at managing currency fluctuations

Where are canola prices going?

To answer that question you’ll need a good handle on factors around the world affecting the oilseed complex

Is a strong loonie a bad thing for Canadian farmers?

There’s no doubt our currency’s fluctuation has effects, but they’re not always well understood

The art and science of farm marketing

There are no pat or easy answers for marketing commodities as each commodity is different

Separating your commodity and currency decisions

Currency fluctuations can be almost as significant as changing prices for your farm products