What goes up…

Barring a sudden market shock, the grain market looks like it is losing steam

Where are markets moving?

Can past patterns give insight into this year’s winners and losers?

When markets burst, it’s never pretty

We’ve seen plenty of price surges followed by collapses. Are commodities next?

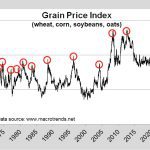

Watching patterns of grain pricing

Have grain prices reached a new trading range, or will they come down?

Financial markets will recover, but when?

Assets are cheap now, but may get cheaper before they recover

The grain-fertilizer balancing act

There’s a strong correlation between grain and fertilizer prices

Dealing with a murky financial future

Forget ripples; the rocks thrown into the financial pond so far have made big waves

No market is an island

‘Interconnected dominoes’ mean factors react with and off each other

The perils of the crystal ball

The quagmire of uncontrolled variables puts any prediction, even expert ones, on shaky ground

How widespread will interest rate fallout be?

Looking at economic history, the effects aren’t always dramatic