* CME live cattle end weaker

* Hog futures supported by higher pork prices

By Meredith Davis

CHICAGO, Nov 7 (Reuters) - Chicago Mercantile Exchange live

cattle futures ended lower on Thursday dragged down by weaker

cash cattle trade, analysts and traders said.

U.S. Plains cash cattle traded at $131 per cwt, $1 lower

than the previous week, feedlot sources said.

There were more cattle for sale this week due to a carryover

from the previous week which pressured prices. Additionally,

with beef packer margins firmly in the red, the plants have a

slower production schedule in an effort to improve the negative

Read Also

UPDATED: CCA calls for end to temporary U.K. trade deal

The Canadian Cattle Association is asking the federal government to rescind a bridge trade agreement between Canada and the U.K. based on the latter’s refusal to accept Canadian beef and pork.

margins, analysts said.

On Thursday, HedgersEdge reported beef packer margins at a

negative $29.30 per head, down from a negative $26.05 on

Wednesday and negative $22.35 a week ago.

"The lower cash cattle trade was not unexpected. With a

slowed kill and larger cattle supply this week, I'm not

surprised," said Doug Houghton, commodities analyst at Brock

Associates.

The U.S. Department of Agriculture's weekly export report on

Thursday morning showed U.S. beef sales last week reduced by

18,500 tonnes from 55,500 tonnes the previous week.

The 18,500 tonnes reduction was an adjustment to the prior

week's data that reflected the lapse of export information

during the partial U.S. government shutdown in early October, a

USDA official said

"The revision takes away some demand that the market thought

was there," Houghton said.

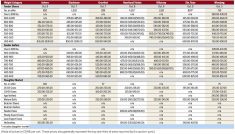

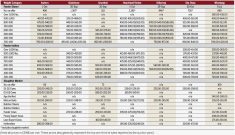

December settled down 0.350 cent at 131.675 cents

per lb, and February closed at 133.550 cents, down

0.3505 cent.

CME feeder cattle futures followed live cattle futures

lower.

November closed down 0.225 cents per lb at 164.625

cents, and January ended at 165.125 cents, 0.425 cents

lower.

STRONG PORK PRICES LEND SUPPORT

CME hog futures ended firmer supported by higher wholesale

pork prices, traders said.

Wholesale pork prices jumped by $2.57 per cwt to $96.15 on

Thursday morning. Hams reversed its downward price trend of the

last two days to gain by $3.08 per cwt to $89.55.

Funds periodically sold their December positions and bought

deferred contracts while conducting a strategy called a "roll."

Funds that use the Standard & Poor's Goldman Sachs Commodity

Index (S&PGSCI) shifted, or rolled, their CME live cattle and

hogs December long positions into February and April. Thursday

was the first of five days for the process.

Solid weekly pork exports also lent support to U.S. hog

futures, analysts said. USDA reported early on Thursday the U.S.

exported 12,700 tonnes of pork.

Concerns about the spread of porcine epidemic diarrhea virus

(PEDv), a fatal disease for baby pigs, also underpinned deferred

month contracts.

December hogs ended up 0.200 cent at 87.550 cents

per lb. February hogs ended up 0.525 cent at 91.400

cents.

(Editing by Marguerita Choy)

LIVESTOCK-CME live cattle ends lower as weaker cash prices weigh

By