Canadian farmers may have received more for what they sold last year, but they paid a pretty penny to get it to market. It showed in their profit margins.

Overall farm income fell by nearly 10 per cent in 2022, according to a recent report from Statistics Canada. Canadian farmers’ realized net income — the difference between cash receipts and operating expenses, minus depreciation and plus income in kind — fell to $12.5 billion, down from $13.8 billion the year before, the May 25 report said.

When cannabis is excluded, the picture is slightly better, with realized net income dropping just over eight per cent to $12.7 billion.

Read Also

Malta bee exporter blasts criticism from Canadian beekeepers

A honeybee exporting firm on the Mediterranean island of Malta says they’re collateral damage to a dust-up in the Canadian honey sector over imports of replacement bees.

Why it matters: Producers will want to carefully manage financial risk in the face of high expenses.

Soaring costs are to blame. Expenses after rebates rose over 21 per cent, from $59.8 billion in 2021 to $72.5 billion last year, making it the largest hike since 1974.

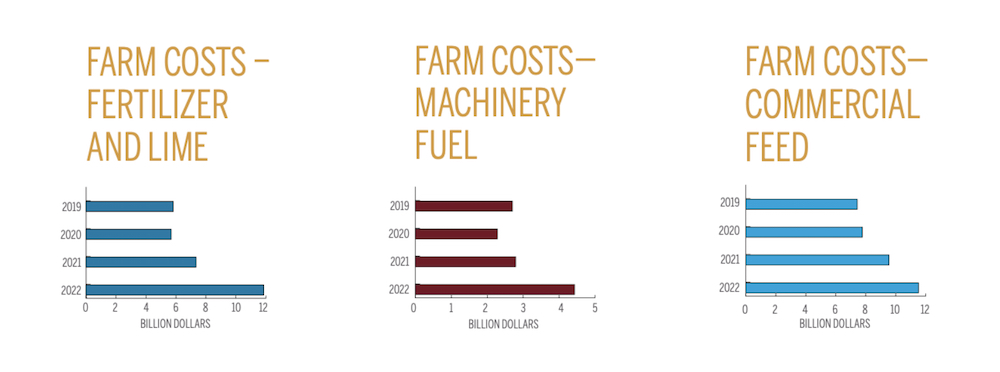

Fertilizer alone increased nearly 62 per cent. Russia’s invasion of Ukraine, followed by economic sanctions against Russia, added pressure to a market already stressed by natural disasters and high natural gas prices, Statistics Canada noted.

Fuel costs added more weight. Expenses increased nearly 60 per cent, with already rising prices bolstered by the war in Ukraine.

For the livestock sectors, feed expenses increased nearly 21 per cent. Stocks of hay and cheaper forage were low due to the 2021 drought and Alberta’s feedlots imported record amounts of corn.

The saving grace was the high prices enjoyed by most products coming off Canadian farms last year.

Farm cash receipts also rose nearly 15 per cent to $95 billion, up from $82.8 billion in 2021, Statistics Canada reported.

The agency pointed to low opening inventories following the 2021 drought and two years of strong export demand pushing up prices. Increased demand for livestock feed also added support to grain markets.

Prices for wheat, excluding durum, rose nearly 42 per cent. Canadian exports of non-durum wheat dropped by 10 per cent last year, but the value of those shipments was almost 26 per cent more than the year before. That market was also backed by the lowest wheat stocks since 2008 coming out of 2021.

Meanwhile, canola prices rose by about 39 per cent.

“Together, the increase in wheat (excluding durum) and canola receipts accounted for slightly more than half of the growth in crop receipts,” the report said. “Soybeans and corn for grain also posted significant gains.”

In the sales ring, livestock receipts were up 12 per cent. StatCan puts the greatest gain in the beef industry, which saw cash receipts rise nearly 17 per cent as the number of cattle slaughtered in Canada reached its highest level since 2008.

What does it mean for 2023 profit?

With the 2023 crop just in the ground, the outlook is challenging, though less volatile than last year.

Since the beginning of the year, grain and oilseed prices have weakened more than expected, said J.P. Gervais, chief economist with Farm Credit Canada.

Manitoba’s cost of production guide, released in December 2022, estimated a new crop price of $17 per bushel of canola, according to Darren Bond, a farm management specialist with Manitoba Agriculture. He’s now seeing new crop prices at $14 or $14.50 per bushel.

Markets appear to be anticipating a slowdown in the world economy and weakened demand, Gervais said. That slowdown has yet to manifest. Consumer spending has been resilient.

“It’s just surprising,” he said.

It will also likely change. Gervais expects the impact of higher interest rates will be felt more as the year wears on and households renegotiate loans at higher interest rates.

“The overall economy to me is going to be slowing down. It’s just a matter of when and the extent of it,” he said.

Volatility adds a layer of uncertainty. The war in Ukraine continues to be a factor, said Gervais. Demand for biofuel feedstock remains unknown, awaiting finalization of the U.S Environmental Protection Agency’s ruling on the amount of ethanol and other biofuels required to be blended into U.S. fuel over the next few years.

The largest variable, Bond added, is the 2023 crop yield.

Cost respite

There has been some relief through lower fuel prices. Diesel has fallen about 20 per cent below what it was a year ago, said Gervais.

Fertilizer prices have also dropped 20 to 30 per cent, said Bond. Manitoba Agriculture’s cost of production estimates put urea at $1,100 per ton in late 2022. It’s now between $700 and $800, Bond said.

However, some farmers will have purchased fertilizer in advance and may not have benefited from the falling prices.

For livestock producers, a slight decline in feed prices has provided some relief, said Gervais. Demand for beef hasn’t slowed, and tight herd numbers are pushing prices up. Feedlots are making money, he said.

At the same time, business at some of the biggest meat processors in North America has flagged. Tyson Foods, which reported issues across its beef, poultry and pork businesses at the same time it announced a quarterly loss earlier this year, cited reduced beef demand, as well as feed and animal price hikes.

JBS recently reported similar business-wide issues and a quarterly financial loss, blaming feed prices and market oversupply.

In the hog sector, several processors have reported losses, attributed to pressures of inflation and difficult market conditions. Some companies have announced plant closures.

This comes after increased domestic slaughter last year. Hog receipts rose just over four per cent in 2022, according to Statistics Canada.

Keep a weather eye open

It’s not “doomsday,” said Bond. “There’s still profit to be had.”

For grain and oilseed farmers, whose crops are just emerging, Bond said it will be crucial to keep a close eye on cost of production. He advised farmers to keep updating their cost of production on a cost-per-bushel basis.

“I’m a big believer in determining your cost of production on a cost per bushel produced basis, so that will give signals for marketing opportunities,” he said.

Give all spending decisions a cost-benefit analysis, he advised further. For example, what is the return expected on crop protection products?

Manitoba Agriculture has a crop disease break-even calculator on its website to help with those types of choices, he added.