The ICE Futures canola market moved higher during the first week of June, as a heat wave heightened dryness concerns across the Prairies. With North American seeding operations nearing completion, attention in the agricultural futures should be squarely on weather forecasts heading into the summer months.

Environment Canada issued heat warnings across all of Western Canada, while key northern growing regions of the United States dealt with similar hot and dry weather.

The old-crop canola situation remains tight and market participants are banking on new-crop production to alleviate supply shortages. It’s still early in the growing season, but timely rains will be needed within the next few weeks or the lack of moisture may start to cut into yield prospects.

Read Also

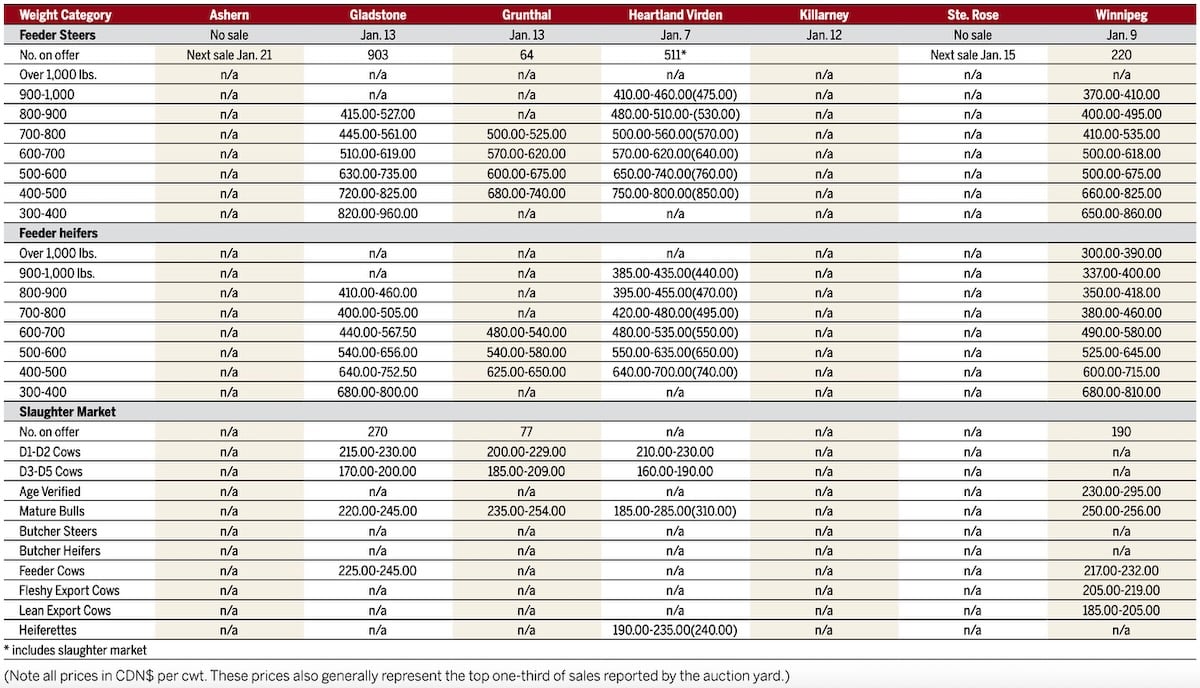

Manitoba cattle prices, Jan. 15

The old-crop July contract has been largely abandoned by commercial traders, leaving the front month open to volatile speculative price swings before its expiry. While the dry conditions should remain supportive overall, the whims of speculative fund traders could lead to surprises.

The old/new-crop spread has started to narrow in somewhat, but remains historically large with a great deal of room to the upside for the new-crop months.

November canola moved above $750 per tonne on June 4, nearing the high for the contract of $759.80 hit a month earlier.

Wide new-crop crush margins of over $150 per tonne above the futures imply that canola is still relatively cheap compared to product values, even at their current strong levels. Demand for vegetable oil especially appears to be showing no signs of easing, with Chicago Board of Trade soyoil hitting its best levels in 10 years during the week.

That strength in vegetable oil was also supportive for soybeans, but better Midwestern moisture conditions tempered upside in the bean market to some extent. Looking beyond the weather, the soybean market in the U.S. was showing a head-and-shoulders chart formation, which could suggest the soybean market was topping out.

Early condition ratings look good for the U.S. corn crop, with day-to-day weather forecasts likely to dictate the futures direction over the upcoming weeks. However, drought conditions for Brazil’s second crop remain a supportive influence in the background.

U.S. winter wheat is also thought to be in generally decent shape, although too much moisture in some regions could be cause for concern.

Spring wheat was the bullish outlier of the U.S. grains, climbing sharply higher on the back of the same weather worries that boosted canola.