Manitoba’s agricultural exports had remarkable growth in 2023.

By the end of the year, $9.39 billion worth of agriculture and agri-food goods had flowed out of the province, an increase of more than six per cent over 2022, according to trade performance summary published by Manitoba Agriculture.

Why it matters: Canadian agriculture is largely an export business and, based on 2023 trade numbers, business has been good in Manitoba.

Read Also

Manitoba Beef Producers take aim at elk surge, feed losses from wildlife

Resolutions at last month’s Manitoba Beef Producers meeting seek help to rein in elk and deer populations, expand fencing supports and improve compensation for wildlife damage.

Growth is not as fast as it was in 2022. That year, a similar report noted the province’s agriculture-related exports leaped by 13 per cent, to a value of $8.8 billion. But it is faster than all other trade in the province. Manitoba’s total exports did grow in 2023, by about 3.9 per cent.

Keystone Agricultural Producers general manager Brenna Mahoney said growth in agricultural exports is a testament to the dedicated work of farmers.

“Manitoba farmers are global leaders in producing the agricultural products the world needs,” she said. “The sustainable and reliable production methods employed by farmers in Manitoba and across Canada continue to lead the way in the increased global demand for our products.”

Manitoba’s numbers are also on pace with national trade. Canada’s agricultural exports grew 6.7 per cent, to $99.1 billion, in 2023.

“The growth of agricultural exports from Manitoba underscores their importance to the Manitoba economy and the tens of thousands of good jobs our sector supports,” said Mahoney.

Top performers

The province’s top five export categories were oilseeds and oilseed products, grain and grain products, meat and meat products, soybeans and pulses, and potatoes.

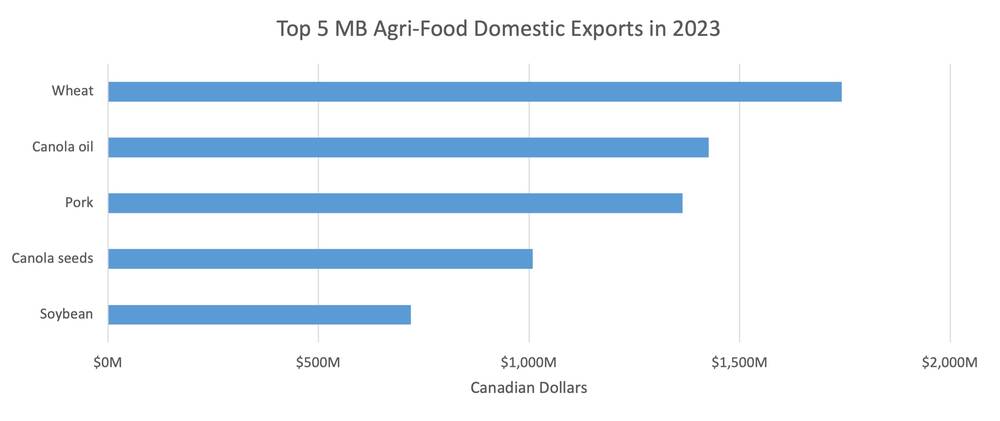

An itemized list off of Manitoba Agriculture’s trade dashboard showed that more Manitoba wheat moved in 2023 than any other agricultural product, but the second- and third-most exported products were canola oil and canola seeds. Combined, that helped launch oilseeds and oilseed products to the top of Manitoba’s export growth in terms of value, and second in terms of percentage growth.

The oilseed category represented 32.9 per cent of all Manitoba’s 2023 agricultural exports and grew 12.54 per cent year to year. About $3.1 billion worth was sold in 2023, $344 million more than in 2022.

Manitoba Canola Growers president Warren Ellis was happy to see those numbers.

“It comes from a lot of work that the entire industry is doing. Exporters have come to rely on the quality that comes from the farmers,” he said. He also talked up the support network of plant breeders and seed development companies.

“It means we’re always on the leading edge in terms of genetics. That helps.”

Grain and grain product values rose $249 million (11.49 per cent) to $2.4 billion. Wheat represented the bulk of those exports, at 75.8 per cent, followed by oats at 15.8 per cent.

Meat and meat products also saw robust gains. Exports in those sectors grew by $111 million (8.15 per cent) to $1.5 billion in 2023, with the growth led almost entirely by pork.

Manitoba Pork Council general manager Cam Dahl said those exports are critical to Manitoba’s pork industry and, in turn, to the provincial economy.

“Ninety per cent of the eight million pigs we raise every year are exported,” said Dahl. “The pork industry contributes 22,000 jobs and $2.3 billion every year to the Manitoba economy. So it’s a big deal.”

Dark cloud

Other sectors haven’t been rushing ahead to the same degree.

Although still Manitoba’s fourth-largest group of exports, soybeans and pulse values declined by $67.8 million (6.55 per cent) to $968 million. That’s a fall in fortunes compared to the previous year, when a similar report from Manitoba Agriculture had flagged the category for the third-largest export gains of 2022.

Live animals, pigs included, also didn’t fare nearly as well as their finished product. The value of those exports dropped 10.83 per cent on the year to $408.4 million.

Shipments of food and beverage ingredients were valued at 20.5 per cent less at 39.37 million, and other reductions were noted in potatoes and potato products, byproducts and dairy and eggs, which saw exports drop by 33.5 per cent to $8.12 million.

Top destinations

The usual top four destinations for Manitoba products took their places again in 2023. The U.S., China, Japan and Mexico represented the bulk of sales, with the U.S. alone accounting for almost half of the province’s agri-food exports.

The southern neighbour continues to be Manitoba’s top customer, buying $4.53 billion worth of agricultural goods in 2023, two per cent more than the previous year. Of that, canola oil made up 29.8 per cent of sales, followed by frozen potatoes at 13.9 per cent and canola cake at 8.5 per cent.

China was the second-largest destination and registered the largest export growth in value, reaching $1.59 billion in 2023. The top exports to China were canola seed, soybeans and wheat.

Japan received 8.7 per cent of Manitoba’s total agri-food exports in 2023. Pork cuts led the way, accounting for 60.7 per cent of agri-exports to the Asian nation. It was followed by wheat at 18.2 per cent and canola seed at 18 per cent.

However, agricultural exports to Japan decreased from $912 million in 2022 to $816.1 million in 2023, largely because of a decline in canola seed exports.

Mexico also saw a decline in exports from Manitoba. The $553 million exported in 2023 marks a 13.9 per cent decrease from 2022. The main exports to Mexico were pork, canola seed and canola oil.

With the exception of some flip flopping in rank between China and Japan, that top-four list has been consistent since at least 2019.

The spot for Manitoba’s fifth-largest customer has seen a lot more jostling. In 2023, South Korea took the slot, accounting for just over two per cent of exports. It also had one of the biggest percentage increases as a destination for Manitoba trade.

Exports to the East Asian country grew by $66 million to 124 million, a 52.9 per cent increase over 2022. Of that, most was pork (85.1 per cent) or wheat (6.7 per cent).

That fifth position was previously held by either Iran or Indonesia since 2019.

The Indo-Pacific has drawn a lot of trade attention from Ottawa. It opened an agriculture and agri-food office in the Philippines after signing the Comprehensive and Progressive Agreement for Trans-Pacific Partnership with 10 other Pacific-touching nations.

Livestock sectors, including Manitoba’s beef and pork industries, have praised that deal for increased market access.

Battling protectionism

While the news is generally good for Manitoba’s farm exports, industry is leery of geopolitical and protectionist headwinds.

Most recently, in what many consider a response to announced Canadian tariffs against Chinese-origin electric vehicles, China launched an anti-dumping probe into Canadian canola, placing a chill on trade relations between the two countries and leading to worry that exports of canola seed, Manitoba’s largest export to China this year, will shrink.

Ellis, who farms near Wawanesa, said producers are used to dealing with risk, whether it comes from weather, weeds or insects, but trade disputes add a wrinkle over which they have little control.

“Now we have another risk that is forced upon us from time to time; a political risk that can damage markets,” he said.

Dahl also cited pork industry challenges. His organization has been outspoken against measures like U.S. country of origin labelling (COOL) rules for meat.

The U.S. says its new version of the rule is voluntary, dodging the trade rule violations that led to cancellation of the original COOL. Canadian industry argues that, in practice, it will create many of the same barriers as mandatory labelling.

“COOL has the potential to have some significant impacts on our live pig exports,” said Dahl, adding the province needs to work with the federal government to ensure unimpeded access to international markets.

He said there must be an understanding of the threats faced by Canada’s agricultural industry and economy during cases of political gamesmanship.

“My message would be to focus on the need to have a comprehensive response to those threats and to ensure that we’re ready for a review of things like CUSMA (Canada U.S. Mexico Agreement, soon to be renegotiated),” he said. “We have to spend some effort as a province to maintain our markets and to see if there are alternatives should blockages in trade arise.”