It’s time to up the limit on cash advances.

Doubling the limit on cash advances to $800,000 will help western grain farmers struggling with reduced cash flow due to the grain transportation backlog, says Canadian Canola Growers Association (CCGA) CEO Rick White.

It’s also justified because the limit hasn’t been increased for 12 years and farms are bigger now.

“We’re talking about the transportation challenges, which is a marketing challenge right now,” White said in a March 20 interview the day after he made the same point to the House of Commons agriculture committee’s emergency meeting on the backlog. “Plus, this hasn’t been ‘right sized’ since 2006. We all know that farm size has gone up. Farm expenses have certainly gone up over time, inflation. We talk to a lot of farmers… given we have 10,000 advances out in any given year… and they have been telling us for quite some time that the $400,000 limit is a bit restrictive at times of the year. They have said they would like to see an increase. Large customers say the current $400,000 isn’t enough for them to take an advance.”

Read Also

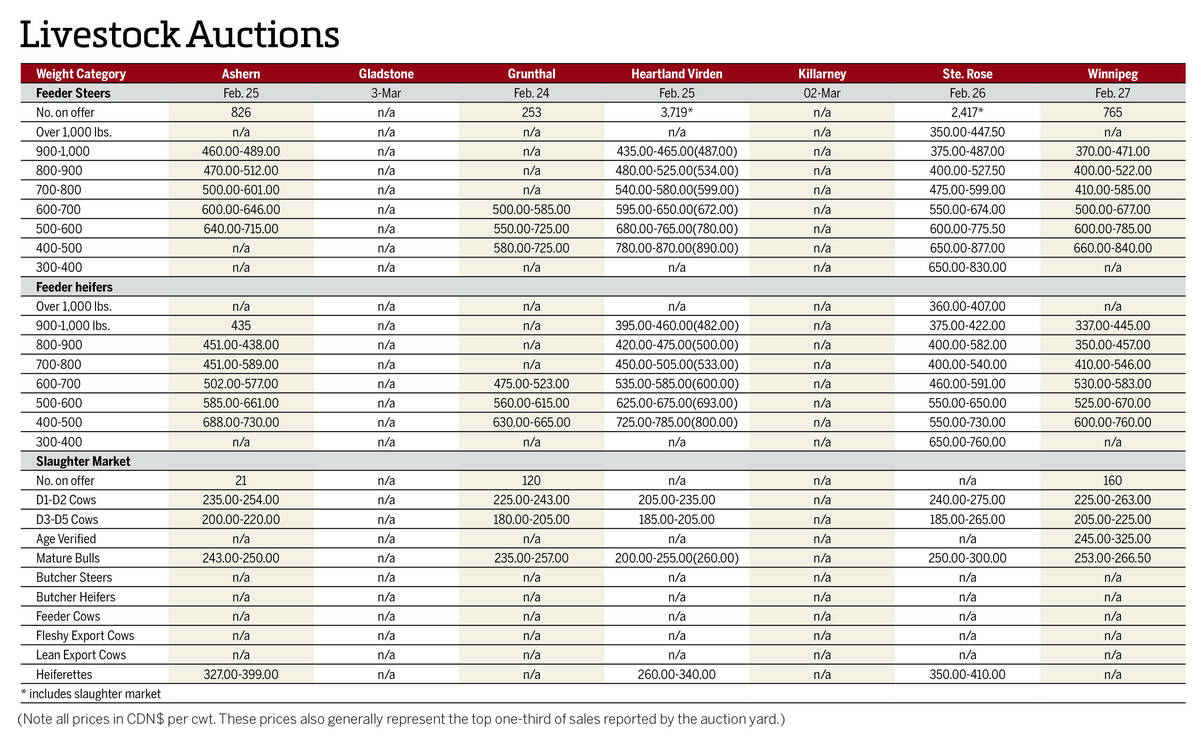

Manitoba cattle prices, March 4

Chart of weekly Manitoba cattle prices.

The CCGA is one of several farm organizations that administers the federal government’s Advance Payments Program, which loans farmers up to $400,000 against the value of stored crops and other farm produce. The money is repaid when farmers sell their produce. The first $100,000 is interest free and covered by Ottawa.

Loans administered by the CCGA some years exceed $1 billion.

“We don’t see a financial firestorm coming right at this present moment, but again we’re not through this (backlog) yet,” White said.

“We saw it very clearly in 2013 (with an extra $300 million in loans), but… I told the agriculture committee we’re not seeing that kind of financial impact, or run on finances, at least not yet. And I underscored yet.”

White also emphasized increasing the cash advance limit won’t fix the grain backlog, but it is a proactive move to assist farmers.

“It’s one thing not to be able to sell your grain, but another for your cash flow to dry up on you because of that,” he said.

“What it is, is making credit through the program more readily available for farmers who need it. Don’t need it, don’t take it. Hopefully it’s a financial bridge that helps them because we’re coming into seeding. They’re going to be spending money on fuel, fertilizer, seed — all those expenses will be coming at them and they’re going to need cash and they do need cash. We think an expanded limit on the program will give them an option to at least get themselves through this time and financially not be in a pinch.”

White gave an example of how the current limit hurts farmers who borrowed the maximum $400,000 in 2017. If they only repay $100,000 by April 1 — the start of another program year — they can only borrow another $100,000, assuming they have grain to secure it.

“Why not let them borrow another 400 grand and top it up to an overall limit of $800,000? White said. “That’s when the limit becomes important.”

Doubling it won’t cost the government more because the $100,000 interest-free portion won’t change, he added.

The risk of defaults, currently at around one per cent, shouldn’t change either, he said.

The loans are based on half the value of the farmer’s inventory, which allows for a wide fluctuation in produce prices, White said.

The CCGA’s interest rate is CIBC’s prime rate — currently 3.45 per cent.

“It is a very good deal, especially when you consider the $100,000 is interest free and then the interest bearing (portion) is probably better than what farmers could ever get on their own,” White said.

Raising the limit will help some farmers, but passing Bill C-49, the Transportation Modernization Act, is what’s needed to address the backlog, White said.

“We need it before the start of the new crop year because we cannot go into next year in the same situation that we find ourselves today.”

The first cash advance program was introduced for Canadian Wheat Board crops in 1957 by John Diefenbaker’s Conservative government. It was meant to give farmers cash flow as they waited to deliver grain under various wheat board quotas.

A separate, but similar program, was introduced in the early 1980s for non-board western Canadian crops, allowing farmers to hold out for better prices.