Canada’s recent trade understanding with China isn’t perfect, says the Manitoba Canola Growers Association, but they’re happy there’s been movement at all. They also hope it’s just the first step.

“It’ a toehold,” said association chair Warren Ellis during Manitoba Ag Days Jan. 20. “It’s like that guy that comes to your door and you open the door a crack and he sticks his foot in … you hope to get more out of it later.”

The association is going to keep pushing the issue with government in hopes of getting an even better deal — one that’s more long term.

Read Also

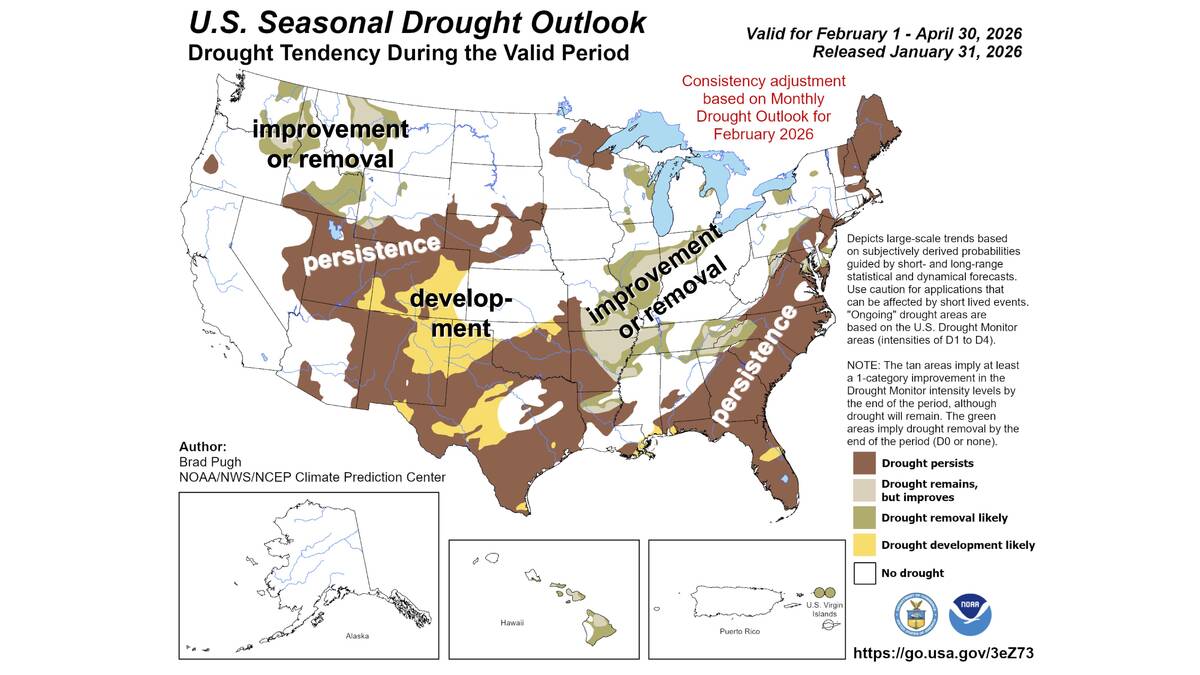

Neutral conditions drive 2026 weather as La Niña subsides

U.S. government meteorologist expects there will be neutral ENSO conditions for the 2026 farm growing season.

“But it’s a start, and that’s a wonderful thing,” Ellis said.

“If we just hold out for the perfect deal, we won’t get any deal at all,” he later added.

WHY IT MATTERS: Canola trade to China, Canada’s second-largest customer for the oilseed, ground to a stand-still for months after China slapped 75.8 per cent tariffs on seed, on top of a 100 per cent levy on canola oil, meal, peas and 25 per cent tariff on pork and seafood in place since last spring.

The agreement-in-principle — which expects to reduce tariffs on Canadian canola seed down to 15 per cent and eliminate the duty on peas and canola meal as of March 1 — is lacking on some points, Ellis said, but it seems to be a change in approach between Canada and China. That trade relationship has been frosty in the past decade, including another tiff over canola in in 2019 when China put the breaks on shipments from Richardson International and Viterra.

Canola market reaction

Farmers saw some market optimism immediately after the deal’s announcement. There was renewed canola buying from China. Reuters reported 60,000 tonnes newly headed to China for March delivery — the first shipment planned since October.

ICE canola futures briefly jumped by C$17 on Jan. 16, according to an update from Glacier MarketsFarm. Within hours that had tempered to a $3-per-tonne gain.

As of Jan. 20, futures were still creeping higher. March contracts were up $2.30. On the higher end, November contracts were up $5.70 as of 10:45 a.m. central time.

At the same time, Intercontinental Exchange canola futures lost ground among old crop contracts on Jan. 20, Glacier MarketsFarm also reported.

Ellis isn’t disappointed about that less-than-bombastic market movement. It’s indicative of the facts of the deal, he said. The agreement “is good, but it’s not a silver bullet for the whole problem. And so there’s a slight reaction to the upwards because it is better than it was a few days ago, but it’s not a panacea.”

David Drozd, senior market analyst and founder of grain market advisory company AgChieve, said he’s happy Canadian canola trade with China is moving again. No tariff would be better, he noted, but “in this day and age, with all of these tariffs flying around, 15 per cent — I think if a customer is really looking for the seed, I’m not so sure that’s a huge detriment at the moment,” he said.

Canola industry pushes

Remaining concerns include the deal’s shelf life — only until the end of 2026 for canola meal.

There’s also been mixed good news and bad news in other agriculture sectors.

Grain market analysts have seen positive direction in the pea market, Pulse Canada recently told Glacier FarmMedia. Canadian beef exports could soon be headed back to China after a four-year pause, the Canadian Cattle Association celebrated Jan. 19, but so far there has been no movement on pork tariffs. Canola oil was likewise excluded, noted Brittany Wood, senior manager of transportation and trade policy with the Canadian Canola Growers Association (CCGA).

“There’s work to be done, I think,” Wood said. “We’ve got to see what happens in terms of actual trade flow.”

The CCGA would like to see the remaining seed tariffs reduced yet more and the tariff on meal eliminated. “It’s important for oil as well,” she said. “We definitely have a U.S. (oil) market, but if you just go back through the trade history of canola oil exports to China, there have been significant volumes that have gone to China not that far back.”

The CCGA would also like to sort out details like the deal’s timeline. They’re posing those questions to government.

“Hopefully we can have a little bit more information … but I think we’re feeling this is a really good step in the right direction,” she said.

Fresh farmer voices

Other farmers are less effusive about the deal.

Producer Steven Beochers says he won’t be heaping praise on the federal government. “These tariffs are their fault in the first place,” he said. “Now they’re getting the recognition of taking them off?”

China’s anti-dumping investigation, which lead to the tariffs against Canada, came in the wake of 100 per cent tariffs Canada placed against Chinese electric vehicles, following the lead of the U.S. The move outraged farmers, who accused Ottawa of sacrificing their Chinese market to protect a domestic electric vehicle market that hadn’t yet found its feet.

The deal will likely make a positive difference for canola, Beochers said. At the same time, he added, farmers currently have a lack of trust on the issue.

“We’ll see if it pans out,” he said. “We got a little blip in the market.”

Lorne Warkentin, meanwhile, says he has mixed feelings. “I think its good for canola price, but otherwise, I want to be a little careful with what we do with China,” he said.

He says he would have expected a more impactful response in the market after the deal was announced.

Muted U.S. response

News of Canada’s new trade footing with China led some analysts to ponder the reaction of the U.S., which is currently embroiled in its own trade issues with China.

On Jan. 16, however, Reuters reported supportive comments from U.S. President Donald Trump. “It’s a good thing for him (Canadian Prime Minister Mark Carney) to sign a trade deal,” Trump was quoted as saying. “If you can get a deal with China, you should do that.”

Canola industry and grain market experts at Manitoba Ag Days were also less than concerned.

“Whoever we’re marketing grain to, if they need the product, they will come to Canada for it,” Drodz said, “and I actually think this is a good thing that we’re starting to see some effort to find markets outside of the U.S. It’s something we should have done a long time ago.”

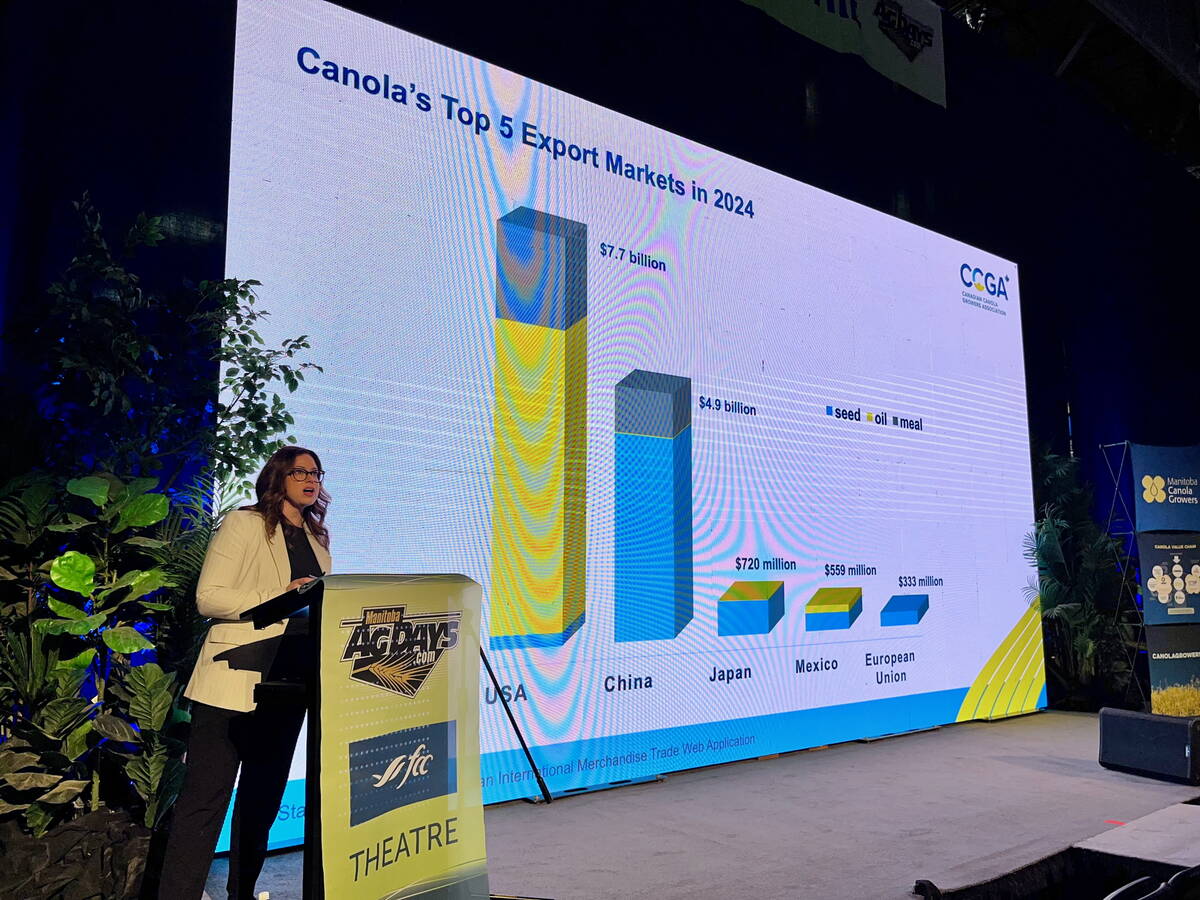

The U.S. remains Canada’s most important canola market, Wood noted. About $7.7 billion worth of canola oil, meal and seed (oil being the largest market) heads directly south, compared to $4.9 billion to China (mostly seed). The CCGA is attuned to what’s happening in the U.S. and the looming review of the Canada-U.S.-Mexico agreement, she said.

While everyone was aware of the trade sensitivities, she noted, “We had to get that China market open. It was important to us, important to canola farmers.”

For more Manitoba Ag Days coverage, check out the Manitoba Co-operator’s Ag Days landing page.