Farmers have side-eyed grocery prices long before surging food inflation began to hit headlines during the pandemic.

‘Who’s that going to?’ they might have grumbled, looking at the price tags on products that could have been made with components off their farm.

‘It sure wasn’t me.’

Read Also

Farm Credit Canada forecasts higher farm costs for 2026

Canadian farmers should brace for higher costs in 2026, Farm Credit Canada warns, although there’s some bright financial news for cattle

According to data gathered by a national farm advocacy group, the complaint isn’t just in farmers’ heads.

WHY IT MATTERS: Canadians are paying more for their groceries, but the farmers growing the food probably aren’t the ones in the value chain enjoying gains, advocates say.

The National Farmers Union argues that Canadian farms are getting shorted when it comes to revenue generated from rising grocery prices.

Net farm returns are either stagnant or shrinking, they said during a May 22 webinar, and it’s not a recent phenomenon.

“We conclude that Canadian farmers have not been able to pass on increasing input costs, nor have they seen any benefit from increased retail grocery prices,” said the union’s policy director, James Hannay.

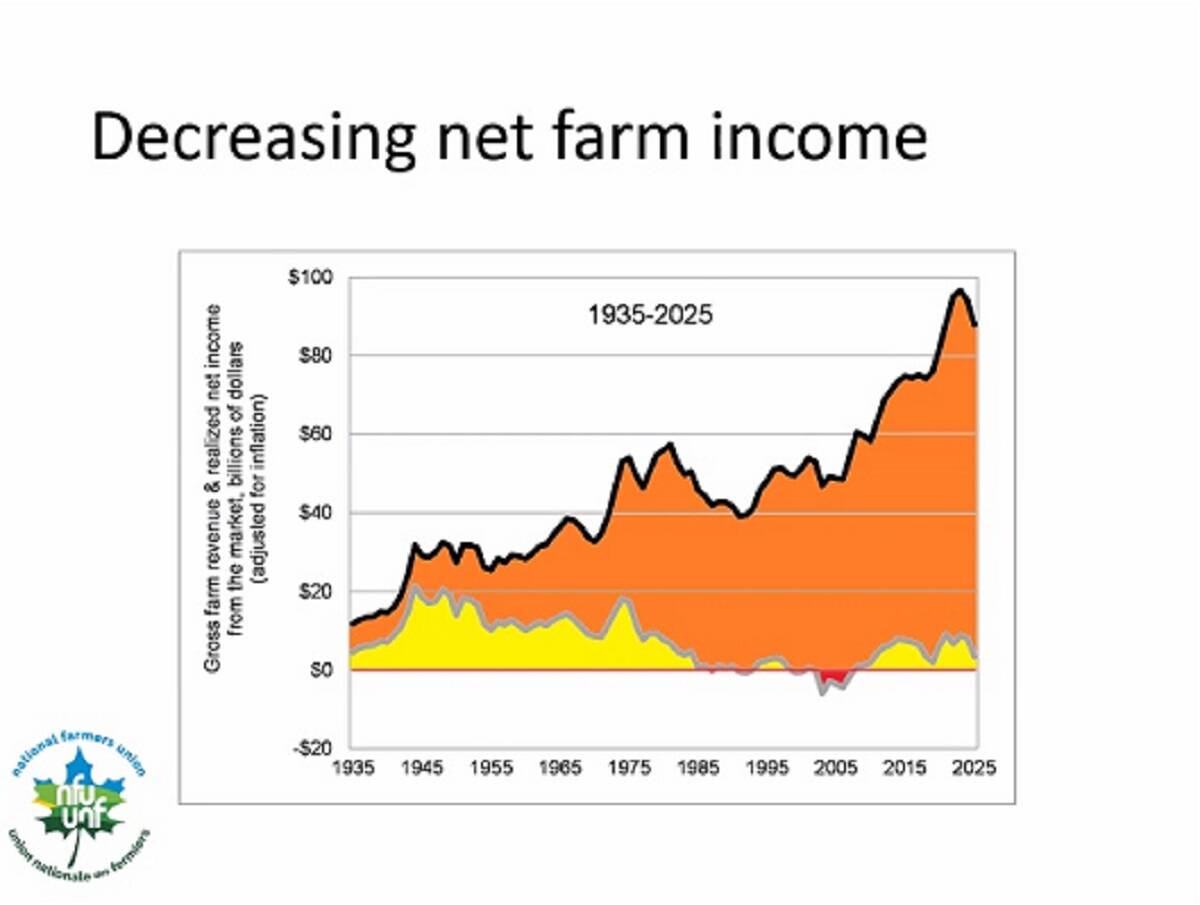

From 2005, gross farm revenue has been generally climbing. That year, farms brought in a gross $50 billion, adjusted for inflation. It’s projected to hit almost $100 billion in 2025.

That sounds like good news for farming, but that’s before expenses kick in. That same year, 2005, saw net income hit negative values.

Net income dug itself out of the hole following that year, but it has failed to match gross income’s rise. In fact, Hannay noted, it’s been more or less constant over the last 20 years, except for a period around the COVID-19 pandemic, where it actually crashed. It’s projected to come in under $10 billion in 2025, Hannay said.

“This shows that the margins Canadian farmers face are razor-thin. Part of this has to do with the low prices that farmers receive, but is also due to rising input costs,” Hannay said.

Their data is based on information from Statistics Canada, historical reporting from Agriculture and Agri-Food Canada, trade reports and original price reporting from grain and corn elevators, the union said.

Amanda Norris, senior economist with Farm Credit Canada, said the federal government doesn’t keep consistent track of farmers’ portion of food revenue, but the United States Department of Agriculture’s Food Dollar Series provides helpful data on the subject.

Its most recent report in 2023 found 9.1 cents of every dollar spent on food in the U.S. (not including beverages) was allotted to farm production.

Farm prices prey to ‘systemic imbalance’

If producers aren’t making the money, who is? According to some experts, it’s everyone in the middle of the supply chain and, in some cases, end users like restaurants and grocery stores.

Price disparities between producers and downstream links such as processing and retail represent a “systemic imbalance,” wrote Gumataw Abebe, an assistant professor and food value chain researcher with Dalhousie University’s business and social sciences department, in an email.

Although processors and retailers indisputably add value, Abebe says their “disproportionate” capture of profit raises questions about fairness, resilience and the future of farming.

“Trade tensions and supply chain disruptions reduce investor confidence and raise operational costs; these challenges disproportionately burden farmers, who have limited ability to pass on costs,” he said.

“Therefore, the gap between farm gate and retail prices is not just a pricing issue.”

That imbalance is rooted in “structural power differences, value-added concentration downstream, market behaviour and consolidation, and global trade and input cost volatility,” he added.

This also results in an environment where consumers are vulnerable to a retail phenomenon Abebe calls “price stickiness.” Retail prices rise quickly in the face of increased costs, but take their time to drop when costs decline, if they’re lowered at all.

The National Farmers Union, meanwhile, argued that farm gate price disparity and high prices at the checkout line down to the same root. There is “massive corporate power shifting costs to consumers and producers while extracting greater amounts of value and money from them,” Hannay said.

Norris, meanwhile, noted that the food service industry — which includes, but is not limited to, restaurants — consumes a big part of the food revenue pie, but it’s not just food in those numbers being reported by the U.S. food series.

“When we think about the price that you pay in restaurants, you’re paying for the food product, but you’re also paying for the atmosphere,” she said. “You’re paying for somebody to serve you the food, to prepare your food, to clean up your dishes.”

Supply management diverges

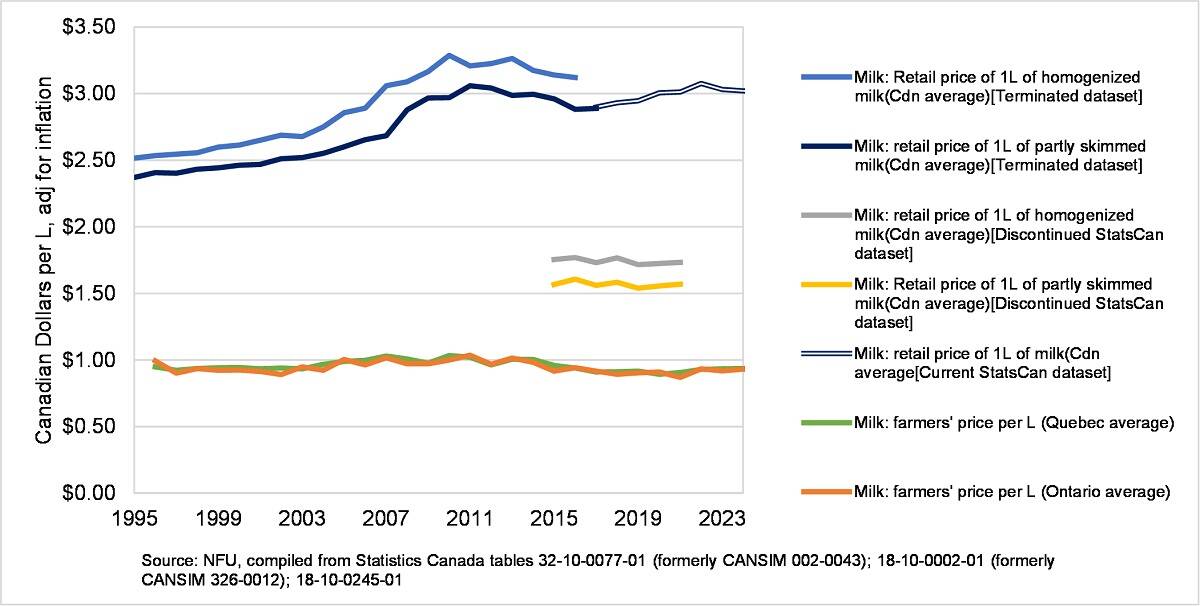

The National Farmers Union had more positive data for supply managed industries like dairy compared to market-priced sectors like grain.

The union is a noted advocate of supply management.

Hannay argued that supply management gives better price and price consistency. He backed up the claim with data comparing the price Ontario and Quebec dairy producers received for one litre of milk over time versus the retail price of that milk, as well as data comparing the price of wheat over time with the retail price of bread.

When it came to the milk, little substantial change in the producer’s price has occurred since 1995. However, being a supply managed product, that was by design, and the retail cost of the milk remained on a slow, largely steady incline.

“Cost of production pricing ensures that farm gate prices for supply managed products cover costs for farmers, ensuring stable prices and adequate compensation for farmer labour,” Hannay said.

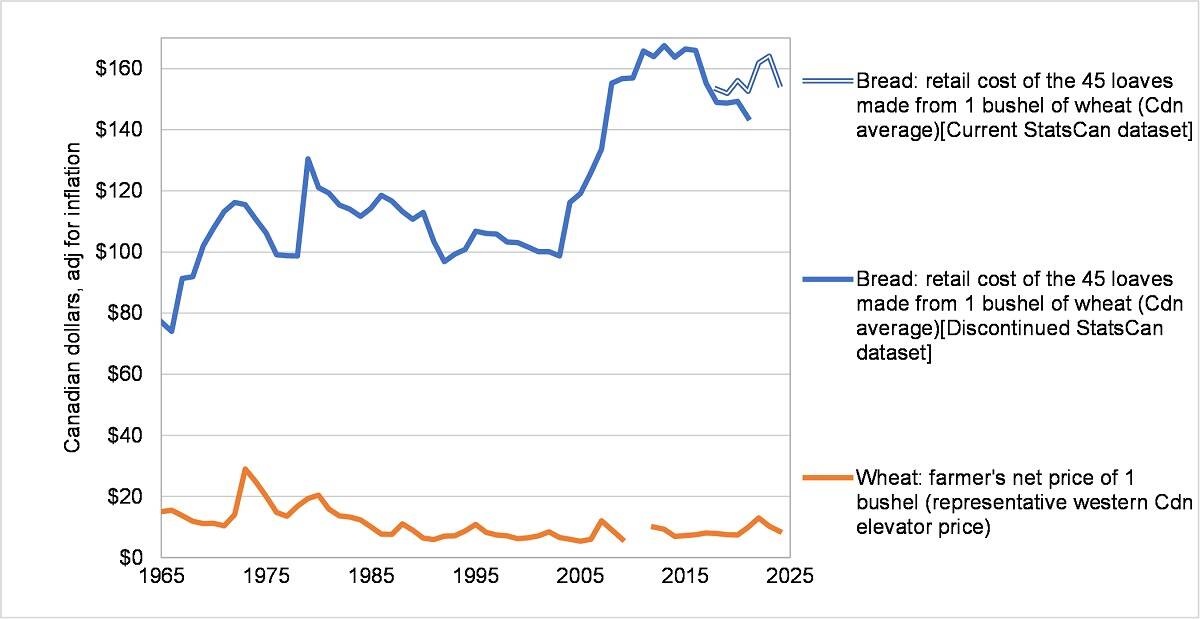

The cost of bread showed more volatility, and the gap between farmer wheat price and retail bread price had widened in recent years, with consumer costs rising and the farmer’s share staying more or less static, the union said.

Since 1965, analysts have used the general rule that a bushel of wheat equals 45 loaves of bread. In 2025, those 45 loaves are expected to retail for about $150, compared to an expected net price of less than $10 per bushel for farmers.

Bread has, however, also been the centre point of a major price fixing scandal. Major Canadian grocers and Canada Bread were found to have inflated bread prices for years between the late 2000s and early 2010s. The case has resulted in multimillion-dollar fines and lawsuits.

Hannay acknowledged the bread fixing scandal, but said bread “is not an outlier in the disparity between farm gate and consumer prices.”

Supply management may be ‘an’ answer to significant price disparity, but not necessarily ‘the’ answer, said Abebe.

The system does have benefits for predictable farmer prices, a guaranteed domestic market, reduced need for direct government subsidies and minimal volatility and waste, he said, but it also “shifts cost burden from taxpayers to consumers, (is) concentrated in a few sectors, does not shield producers from rising input costs, is slow to adapt, debatably restricts imports (and) maintains higher domestic prices.”

The success of such a system is dependent on society’s priorities, be that food security, affordability, rural vitality or market efficiency, he said.

“A balanced food policy should preserve the strengths of supply management where it is most effective, while addressing its shortcomings through complementary reforms.”

Norris, meanwhile, says certain fundamentals must be adhered to regardless of how a sector manages supply and pricing.

“What is consistent across all systems is that businesses must manage their costs. They have to invest in innovation to become more productive. (They) have to make sure they’re operating in the most efficient way they can no matter the system that they operate in.

“And I think that’s really the bottom line. There are different systems, but you must have good business fundamentals in order to succeed in those.”

Turning to direct sales

Low profit margins are one reason some farmers have dropped out of the mainstream food supply system and opted for direct marketing, Abebe noted.

Cutting out the middle of the supply chain allows those farms to retain more value and exercise greater control over pricing he added.

There are pros and cons to that route. It does, for example, require significant additional labour as the farm is suddenly responsible for their own marketing to customers.

One pro, Abebe noted, is the ability of those farms to capture market share by aligning with shifting consumer values.

“There is a growing demand for food that is local and traceable, fresh and minimally processed, produced with environmental and ethical care, and supportive of local economies,” he noted.

“Often, consumers are willing to pay a premium for food that aligns with their values, making DTCS (direct to consumer sales) attractive, particularly for small-scale producers.”

It’s not a marketing system that will be appropriate for every farming sector, he wrote. It works best for perishables that require minimal processing such as vegetables, eggs, bakery goods and honey, all of which are marketed on freshness and provenance.

“Many agricultural commodities produced at a large scale require processing, branding and wider distribution to add value, extend shelf life and access regional or international markets.

“These products may continue to rely on and be better suited to more co-ordinated value-added supply chains which provide scale and efficiency but often at the expense of transparency and lower margins for producers.”

Direct marketing is therefore not a competitor for conventional supply chains, he said, but it is a “promising trend” likely to continue, especially if structural challenges in conventional supply chains stay unresolved.

“They are complementary, each fulfilling distinct roles within the agri-food system,” he said. “A resilient food system must embrace both, recognizing their unique strengths and limitations.”

Direct marketing also allows some producers to expand into processing, retailing and even food service practices to grab a bigger piece of the value chain, Norris noted.

“We can take that 9.1 cents (from the USDA Food Dollar Series) … and if you add processing and you add packaging, you actually get that (producer) share up to almost 25 cents.

“And so there are opportunities to capture different elements of the supply chain … I think that goes back to innovation and efficiencies and seeing where the farm can tap into other markets.”