Canada needs more canola.

There’s the traditional food market for canola oil, but the renewable fuel market is catching fire — and that’s good for farmers and Canada’s economy, says Chris Vervaet, executive director of the Canadian Oilseed Processors Association (COPA).

But more canola seed is needed to take full advantage of the new crushing demand and seed exports.

“Growing canola supplies and productivity increases are critical,” Vervaet told the 26th Annual Fields on Wheels conference Dec. 14. “I can’t say this enough… we need more canola to be grown in this country.”

And it’s not just because the 2021 drought saw the nation’s annual production fall 38 per cent to 12.6 million tonnes versus the five-year average of 20.2 million.

That goes without saying. The market is screaming for those tiny black seeds, which when crushed produce a golden oil used as a food ingredient and to fry food.

Current cash prices are still more than $20 a bushel — an unheard of price until last year.

New-crop prices can be locked in for over $17.

But while the food market is still growing, especially in China and other parts of Asia, the demand to turn canola oil into a low-carbon fuel is taking off in Canada’s backyard, and in Canada itself.

Why it matters: With the new demand for sustainable fuel canola can make farmers and Canada even more money than it traditionally has.

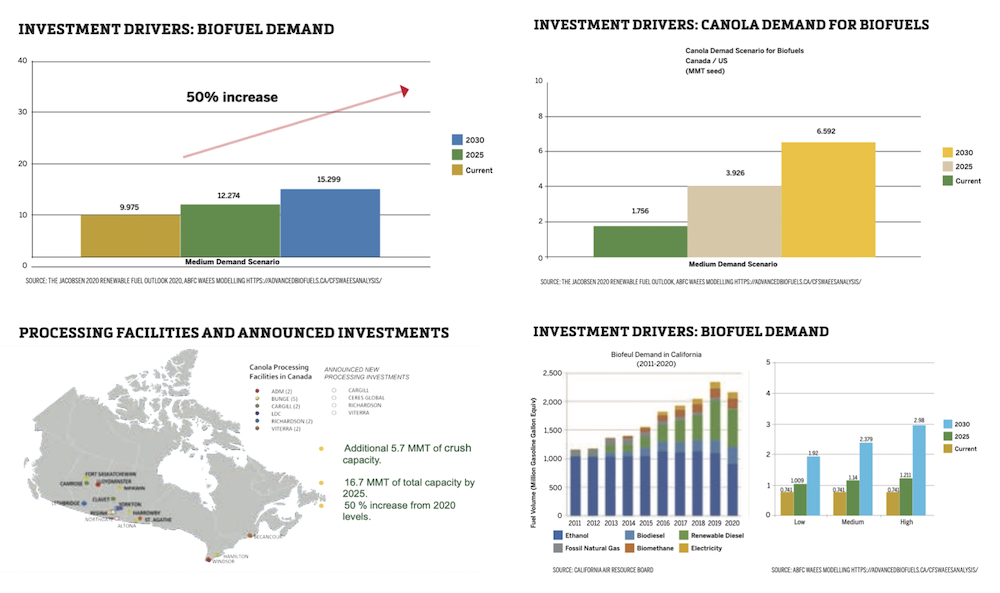

Last year four companies announced plans to build either new canola-crushing plants, or expand existing ones in Saskatchewan, where most of Canada’s canola is produced.

When built there will be another 5.7 million tonnes of crush capacity — a 54.5 per cent increase, totalling almost 17 million tonnes of seed.

“First and foremost is it does create more competition for canola seed, which does raise the overall value of canola in this country,” Vervaet said. “It also provides increased delivery options and flexibility for farmers.”

Instead of 14 crushing plants for farmers to deliver canola to, there will be 17.

It also means adding more value to a Canadian crop, which in turn creates jobs and benefits Canada’s economy.

The increasing demand for canola will encourage companies to develop improved varieties and agronomic practices and encourage more companies to invest in plants turning canola oil into fuel.

The fuel market has a lot of potential.

“It could be large,” Vervaet said. “The message we are trying to get across… (is) we really do have that opportunity to diversify further in our backyard essentially, which is a more predictable market. It doesn’t subjugate ourselves to the whims of a market like China. That said, China is going to continue to be such an important market for us. If it’s not on the seed it will still very much be on both oil and meal.”

North America has a growing thirst for sustainable, bio- and renewable diesel to replace fossil oil burned in semis, big construction equipment, locomotives, jet planes and ships — things, unlike passenger vehicles, that aren’t easily electrified, he added.

Most years Canada’s Cinderella crop, generates more annual revenue than any other, including $10.2 billion in farm cash receipts in 2020, accounting for one-quarter of total crop receipts that year.

What is renewable diesel? Daily news editor Dave Bedard decodes the differences between renewable diesel and biodiesel, why the distinction is a big deal, and how these biofuels differ in their carbon intensity. (video below)

Read Also

Cabbage seed pod weevil the surprise top canola pest in Manitoba for 2025

Get set to scout this summer. After a few years of low profile in Manitoba, cabbage seed pod weevil populations, among a few other pests, boomed here in 2025.

Moreover, a study commissioned by the Canola Council of Canada (CCC) says from 2016 to 2019, on average, canola contributed $29.9 billion to Canada’s economy.

Soybean and other vegetable oils and animal fats are also in demand for fuel but Canadian canola has an edge.

“Our farmers in Western Canada have adopted sustainable production practices such as… no till, which actually does lead to a significantly lower carbon intensity score for canola,” Vervaet said.

“So canola has an advantage in that area just by virtue of the practices that our farmers have been adopting over the last couple of decades.”

While canola oil is renewable, some carbon is emitted to produce the crop, but it’s less than for other non-fossil fuels. And that’s what the market wants, he said.

The CCC, which represents the canola value chain, set a target for Canada to produce 26 million tonnes of canola by 2025 and to crush and export 14 million and 12 million tonnes, respectively.

“Exports are actually already at target so the future growth of more exports is probably ‘challenged,’ but… I would submit probably the most important aspect of making sure our targets are reached… is that we see an increase in the output of canola.

“(T)here certainly is the potential for our sector to blow right past the 14-million-tonne (crush) target.”

During the five years before the 2021 drought Canadian canola production averaged around 20 million tonnes a year from on an average of almost 22 million acres.

With canola crop rotations already tight, the CCC has said its production target hinges not on seeding more acres but on boosting average yields to 52 bushels an acre — a 30 per cent jump for the current 40.

“We don’t really see opportunity to expand the acreage of canola production very much,” Vervaet said, adding agronomy — including better control of weed and insect pests — and improved genetics are key.

In an interview later Vervaet agreed boosting canola yields 30 per cent over the next four years will be challenging, but possible.

“We have farmers who regularly get that yield and better,” he said.

Currently about half of Canada’s canola production is crushed domestically, with the rest exported as raw seed. But if Canadian canola production fails to keep up to demand perhaps as much as 80 per cent will be processed with just 20 per cent exported as seed, Vervaet said.

The current demand of 1.8 million tonnes of canola seed for biofuel is projected to jump fourfold to 6.5 million by 2030, he said. Canadian biofuel demand of about one billion litres a year could more than double to 2.5 billion by 2030.

A number of American companies — mostly already in the petroleum sector — have announced plans for renewable diesel plants.

“If those announcements come to fruition, and all that capacity does get constructed, the growth in renewable diesel production capacity in the United States could truly be remarkable and game changing growing from one billion today to close to five billion gallons is the potential by 2024,” Vervaet said.

While biodiesel — a blend of vegetable and/or animal fat and conventional fossil diesel — has led the way, renewable diesel is expected to overtake it.

“It (biodiesel) does have some limitations with regards to it being blended into conventional diesel,” Vervaet said.

“The difference between renewable diesel and biodiesel is that renewable diesel is chemically identical to conventional fossil diesel so there are no limits in blending. Existing infrastructure used to store conventional diesel and transport conventional diesel can all be used for the purpose of renewable diesel and that’s probably the renewable diesel’s biggest advantage over biodiesel.”

The growing renewable fuel market holds much potential, but Vervaet stressed it’s based on policies implemented by the Canadian and U.S. governments.

“The way I like to frame it sometimes is the biofuel market is a created market,” he said. “It’s not a natural market. It does rely on governments’ biofuel policies and regulations to create the incentives for these types of low-carbon fuels to be used.”

Canada already has a rising tax on carbon making fossil fuels more expensive.

If Canadian canola production doesn’t keep up with the demand resulting in more seed being crushed than exported, more oil tankers and fewer hopper cars will be needed, Vervaet said. However, canola meal exports would increase, some of which could move to the West Coast for export in grain hopper cars, he added.

“And when we talk about more oil in tank cars and meal in hoppers this is all going to be supplied by the member-companies of COPA (as private equipment)… which is an interesting dynamic and differs from what we see in the traditional grain handle,” Vervaet said.

Crushers will likely ship canola oil directly to Canadian renewable diesel companies.

“We’re not talking four or five tank cars at a time. We’re talking about 40, 50 or even maybe 100 tank cars at a time to feed these biofuel plants so there is also a possibility of replacing some of the manifest traffic more commonly associated to when we move our canola oil,” he said.

Canada is expected to enact its Clean Fuel Standard, which will encourage more bio and renewable production and use, by the end of 2022, Vervaet said.