ICE canola futures started the holiday-shortened week ended Oct. 12 by climbing to their highest levels in nearly two months, but quickly ran into resistance and trended lower.

Cool, wet, harvest-delaying weather across the Prairies remained a supportive influence, but windows of opportunity were presenting themselves and canola was making its way into the commercial pipeline. The weekly Canadian Grain Commission report showed heavy farmer deliveries, while the export pace is lagging the year-ago.

Farmers delivered more than half a million tonnes of canola during the week ended Oct. 7, taking the total visible stocks to 1.2 million tonnes.

Read Also

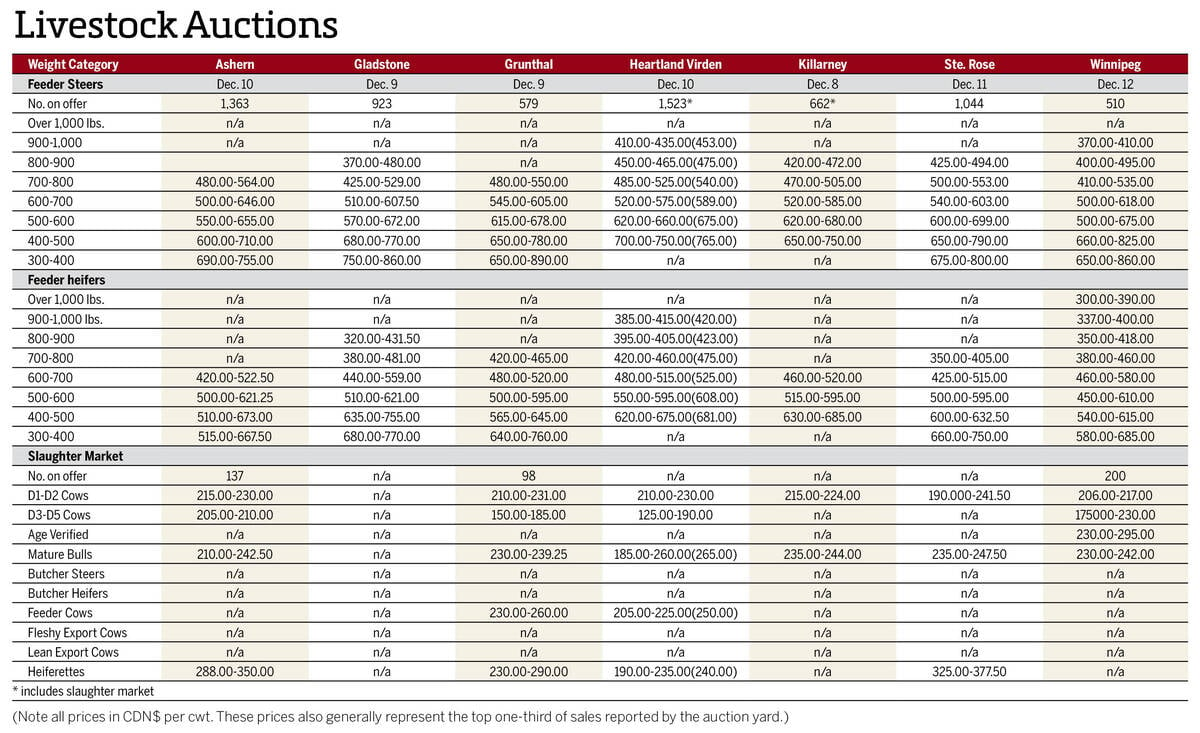

Manitoba cattle prices Dec. 16

Here’s what local farmers were getting paid last week for their cattle at Manitoba livestock auction marts; prices covering the week Dec. 8-12, 2025.

From a chart standpoint, the November contract tried, but ultimately failed at holding above the $500-per-tonne mark. The contract finished the week right around its 20-day moving average, near $494 per tonne, with $490 and then $485 per tonne the next downside targets.

While the forecasts look a bit more favourable for harvest progress heading into the latter half of October, the quality and yields coming off the fields remain to be seen. That uncertainty should be somewhat supportive, but the bigger-picture price influence on canola will remain the Chicago soy complex.

Soybean futures at the Chicago Board of Trade held relatively rangebound during the week, but were climbing sharply higher on Monday morning, Oct. 15.

U.S. farmers are in the midst of corn and soybean harvests, with seasonal selling pressure there likely to temper any potential upside in prices.

Persistent trade issues remain a factor in the U.S. grains and oilseeds as well, with the China situation showing no signs of a quick fix.

The U.S. Department of Agriculture released updated production and stocks estimates on Oct. 11, providing some short-term direction for the futures. The report included a somewhat surprising downward revision to anticipated U.S. corn yields, which gave that market a boost. The soybean yield estimate was revised higher, but more recent harvest-delaying weather has raised some questions over those numbers.

Activity in the three U.S. wheat contracts was choppy, but relatively flat during the week. USDA lowered its world wheat carry-out forecast by about a million tonnes, to 260.2 million. Australia, Russia and other former Soviet Union countries all saw USDA make notable cuts to their respective wheat production forecasts.