December is typically a quiet time for the canola market as traders wind down activities for the holiday season.

Statistics Canada was expected to release its principal field crop estimates on Dec. 4.

Australia has estimated its canola crop at 7.2 million tonnes, 800,000 tonnes greater than last year. Other than those, there appears to be very little on the horizon threatening to shake up prices for the oilseed.

Read Also

Weed resistance closes in on glufosinate

Expanded soybean acres and tighter application windows have eroded buffers that have so far protected Liberty herbicide on Prairie farms

Barring a Christmas miracle of China removing tariffs on Canadian canola, prices are set to move sideways. January canola has remained inside the $620 to $660 per tonne range since mid-October.

However, that doesn’t mean other comparable oils won’t have an effect on canola prices.

The United States Department of Agriculture reported no soybean shipments to China during the week ended Nov. 27, making the China’s prospects of purchasing 12 million tonnes of U.S. soybeans by the end of the year less and less likely. However, news that six cargoes from the U.S. will load for China this month could boost soybean prices and spill over into canola. Speculation over Chinese purchases may be one of the reasons the January contract has increased by more than US$1 per bushel over the past month.

Soybeans from Brazil can fill China’s needs, but dry conditions in the former could trim soybean output. The recent news of five Brazilian exporters being banned from shipping soybeans into China could also raise U.S. futures in the short-term.

Weather has also played havoc in Indonesia and Malaysia, which produce more than 80 per cent of the world’s palm oil and have fallen victim to severe flooding. Many blame deforestation in those countries to make way for palm plantations for worsening the impact of the floods.

Chicago soyoil, which the canola market tends to follow the closest, may see a boost after India locked in more than 600,000 tonnes of South American soyoil imports for delivery in the middle of 2026. As of Dec. 2, the January contract already rose past its 20-, 50- and 100-day averages, approaching the 53 U.S. cent per pound mark for the first time since September.

While all may be calm in the canola market, there’s a slight chance it won’t take a holiday as 2025 comes to a close.

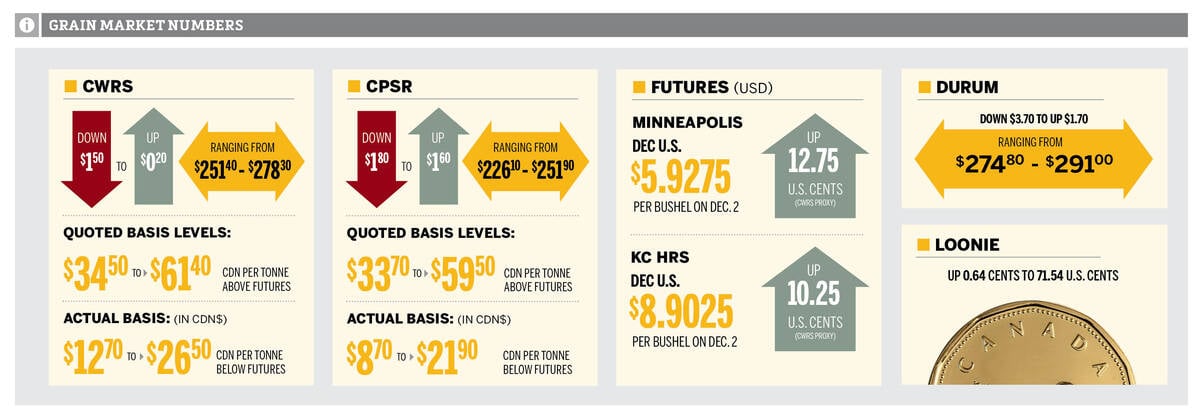

Wheat market numbers Dec. 3, 2025