The reduction in Chinese tariffs on Canadian canola announced Jan. 16 was welcome news for exporters and gave the futures an immediate boost. China is just one piece of a larger puzzle though, and where values go from here remains to be seen.

Charts and exports

Canola futures were already trending higher before Prime Minister Mark Carney struck a deal with China allowing Canadian imports of Chinese electric vehicles in exchange for cuts to Chinese tariffs on canola and other goods.

On a weekly chart, canola futures were trading at roughly the same level in late January 2026 as they were at the same point a year ago — right in the middle of the March lows near C$560 and the June highs around C$750. The likely resumption of trade with China is one factor that could see values return to the upper end of that wide range, but it will be a tough climb.

Read Also

Wheat prices likely headed for sideways trade

U.S. brush with a severe winter storm put only brief upward pressure on wheat futures markets into last week of January.

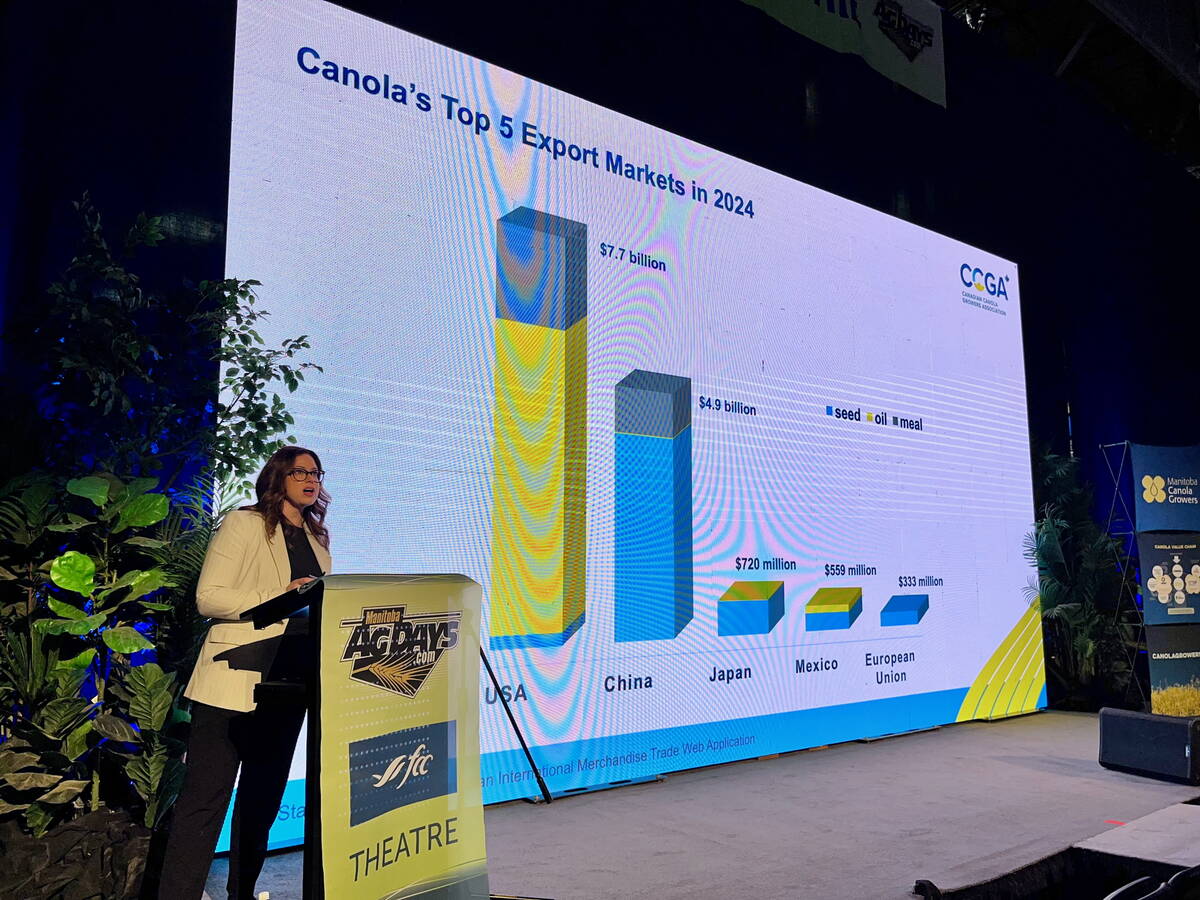

China was the top destination for Canadian canola seed in 2024-25. Those 4.7 million tonnes accounted for roughly half of the 9.6 million tonnes of canola exported during the marketing year. Canada exported 4.9 million tonnes of canola to China the previous year, accounting for 71 per cent of the total sales in 2023-24.

Canadian canola exports through 24 weeks of the 2025-26 marketing year, at 3.2 million tonnes, are running 1.9 million tonnes off the year-ago pace. Exports are down despite record-large production (21.8 million tonnes), with the absence of Chinese buying being the main reason.

Chinese tariffs on Canadian canola seed are expected to drop from roughly 84 per cent to 15 per cent in March, with some business already reportedly taking place.

Over the previous two marketing years, monthly Chinese canola purchases averaged about 400,000 tonnes. If Canada manages to resume that pace — and it’s a big if — that could see China buy two million tonnes of Canadian canola before the close of the marketing year.

Australia

Australia had been locked out of the Chinese market since 2020 due to concerns over blackleg in the Australian canola crop. That dispute was settled in 2025, and Australia has been taking up the slack of lost Canadian business.

Canada does have more exportable supplies than Australia, but lacks the same freight advantage. As a result, it’s unlikely that Chinese buying will turn completely away from Australia.

Ending stocks

Agriculture and Agri-Food Canda is estimating canola ending stocks for 2025-26 at 2.75 million tonnes. That would be up from the 1.6 million-tonne carryout the previous year, but still short of the 3.2 million-tonne ending stocks as of July 31, 2024.

The lack of Chinese buying had some analysts anticipating a bearish situation of ending stocks (four million tonnes or more). That’s less likely now, but market participants will be watching closely for confirmation of actual business.

The new wild card

In 23 years of reporting on the futures markets, I’ve referred to China countless times as a “wild card.” Past trade disputes have repeatedly seen the country come and go from the canola market, as well as the markets for other commodities. The uncertainty of their demand was a certainty itself.

However, every deck of cards comes with two jokers and there is a new wild card to consider.

The chaotic policies of U.S. President Donald Trump’s administration have sent shockwaves though the entire global economy.

Prime Minister Mark Carney made the case for diversity and strength in numbers of middle powers like Canada in his widely watched speech at Davos, Switzerland.

Trump had initially praised Carney for his China agreement. Trump’s tone changed after Davos, with renewed tariff threats from south of the border.

While Canada may not ship much canola seed to the U.S., the country is by far the largest single buyer of Canadian canola oil and meal. The only certainty on trade with the U.S. these days is that Trump’s rhetoric will remain a wild card, highlighting the need for the Canadian canola industry to keep looking for other opportunities as they arise.