If there was ever a year that tested the mettle of Manitoba cattle producers, only for them to see their labours finally rewarded, it was 2022.

The Manitoba cattle industry was in crisis mode at the start of the year, still reeling from the historic prairie-wide drought of the previous summer. Frigid temperatures accompanied one of the snowiest winters in decades and spring rains contributed to overland flooding, which triggered disaster relief from the province. Rising fuel prices and a labour shortage at meat processing plants compounded the industry’s struggles.

Manitoba Beef Producers president Tyler Fulton said these issues eventually led to herd dispersals in the fall.

Read Also

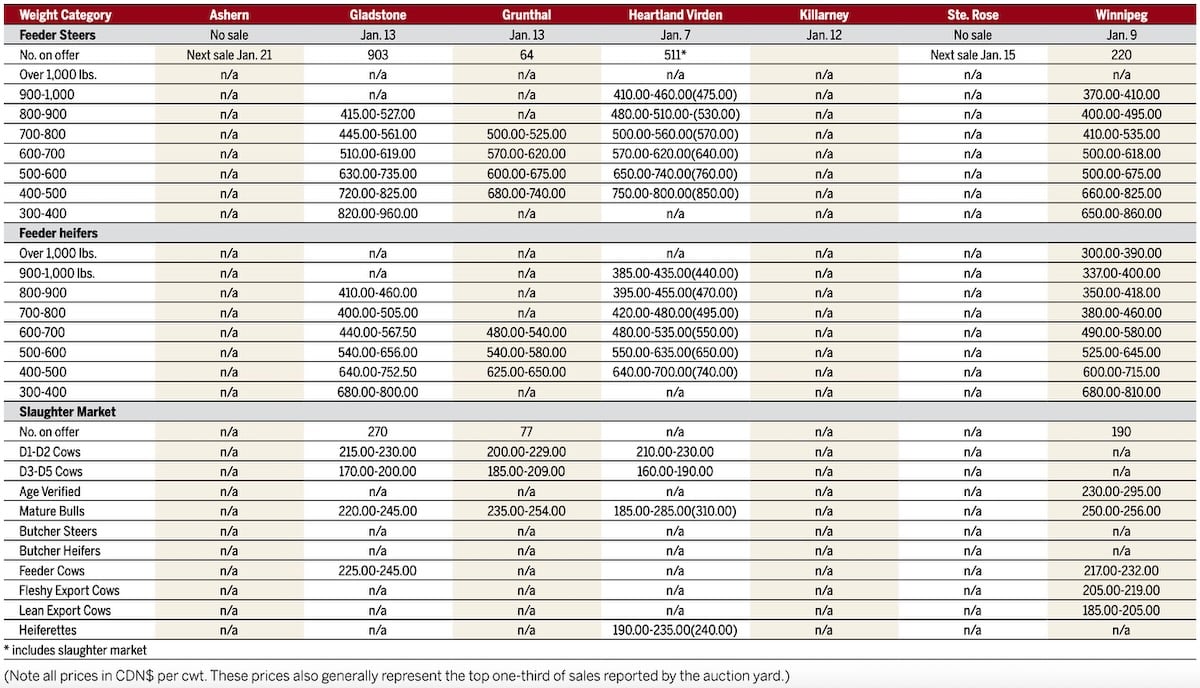

Manitoba cattle prices, Jan. 15

“Earlier in the year, guys were struggling to really find the feed that they needed in order to make it until the new growing season started,” he said.

“Part of that came from all of that snow, cooler temperatures and storms during April and May…The calving season (during those months) for many producers was probably the most challenging timeframe where we were really struggling to maintain the health of the herd.”

As spring gave way to summer, however, dark clouds that hung over cattle producers in Manitoba finally took their leave, literally and figuratively.

The additional moisture, which delayed crop seeding in many places, also erased drought conditions. The ensuing co-operative weather allowed for better hay and pasture conditions. Lower herd numbers – only 12.3 million cattle and calves on Canadian farms as of July 1, the lowest number since 1988 – helped raise prices to levels unseen since 2015.

“By the end of July, it seemed like we’ve kind of turned a corner and things were looking pretty good,” Fulton said. “For much of the province, yields of forage and corn were exceptional. It really had us all breathe a sigh of relief after real constraints on production.”

The summer also marked a pair of successes for the national cattle industry. In June, the Canadian Cattlemen’s Association successfully campaigned to reverse Health Canada’s plans to add nutritional warning labels to beef products. One month later, it revamped both its logo and its name, adopting the more inclusive Canadian Cattle Association as its moniker.

Fulton estimated there was a 50 cent per pound increase in calf prices last fall compared to one year earlier, but noted it still paled in comparison to other commodities.

“For those producers who have a choice between using their land for crop production or for pasture and hay production for cattle, it was still difficult rationalizing using the land for cattle on margins (alone),” he said.

Anne Wasko, an Eastend, Sask.-based cattle market analyst for Gateway Livestock Exchange Inc., said western Canadian cattle prices in 2022 were the second-highest ever behind 2015. She also called 2022 a “top-five” year for demand, though not quite at the levels of 2020 and 2021.

However, high prices for cattle don’t necessarily mean high profits.

“(High prices are) a pretty good story. But I think there are so many other pieces that moderated that really good news in terms of high costs of production, whether it’s feed prices, energy costs, interest rates. All those other things really took a pretty good bite out of those good cattle prices,” Wasko said.

While Manitoba cattle producers fared better than their counterparts in Saskatchewan and Alberta, where many areas still battled drought, shrinking cattle numbers were the common factor across North America.

“The United States was in their third, and in some cases, fourth year of liquidation, largely due to the drought in big parts where the U.S. beef cow herd resides,” said Wasko.

“The U.S. Department of Agriculture and several other agencies are suggesting anywhere between five to six per cent less beef available in 2023. Those things are certainly going to continue to lead towards higher cattle prices in 2023.

“We should see some reprieve on the cost side and Mother Nature could sure help us out in that regard.”

Wasko expects demand for beef to pull back after the holiday season, adding that consumer preferences, interest rates and a potential recession will further affect demand.

Fulton said he expects another increase in cattle prices before the 2023 fall run. He predicts an average price of $3 per pound, which he thinks would make the Manitoba cattle industry more sustainable.

“We’ve got really strong demand from Ontario feeders that are dealing with better basis levels on the fat cattle market. I think it will trickle down a little bit more into what they are paying for feeder cattle or calves going into the fall run,” Fulton said.

“We’ve also got strong support for feeder cattle moving west because there are pretty solid live cattle futures that support decent margins going forward for feed yards. It’s that scenario of East versus West that I think does bode well for Manitoba’s cow-calf operators.”