People who embark on lengthy cross-country journeys have always intrigued and inspired me.

It takes a certain kind of dedication. I had a poster of “Man in Motion” Rick Hansen on my wall as a child and Terry Fox is obviously a legendary hero to all of Canada, but there are countless folks every year who, like Forrest Gump, just felt like running or biking or walking or using some other mode of transportation.

Sometimes it’s to raise money for a cause, sometimes it’s to beat a record, and sometimes it’s just because.

Read Also

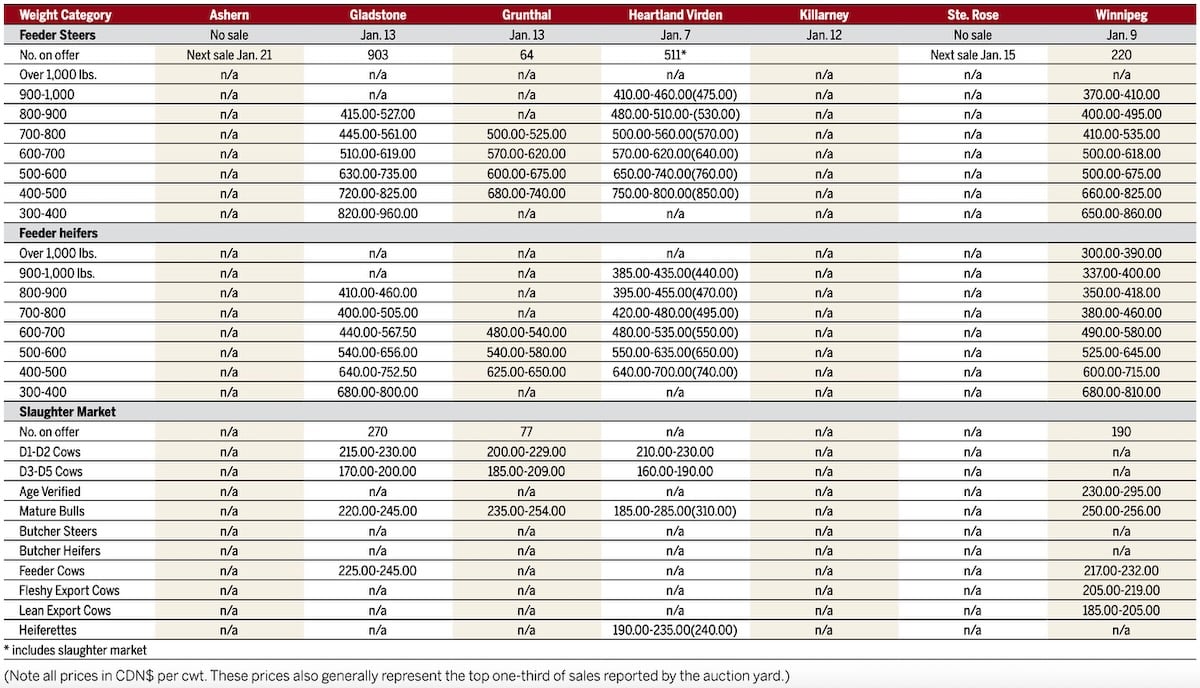

Manitoba cattle prices, Jan. 15

Lately I’ve been following daily updates from skateboarder Chad Caruso as he attempts to skateboard across the United States (find him on YouTube and Instagram). Starting from California in late April and heading east, he crossed the Mississippi River at the beginning of May and is in the final third of the journey by pushing a skateboard for 50 miles a day or more. Caruso’s positive attitude through his journey to raise money for addiction awareness is infectious and can offer us all some lessons.

Seeding

Every growing season starts much like a cross-country trip. Plans are made but inevitable detours come up along the way. Weather conditions will obviously be followed closely. Day-to-day forecasts and their potential impact on planting progress or acreage shifts are major factors to watch in the markets over the next month.

Spring wheat seeding was running behind schedule in the U.S., underpinning Minneapolis futures, but shifting weather patterns have changed that attitude. Warm temperatures were drying out fields across Western Canada and seeding should be in full swing.

Cattle

A highlight of Caruso’s videos is how he greets all the cows he passes with a friendly ‘yo! what’s up?’ Live and feeder cattle futures in the United States were trading at their highest levels over the past decade in early May before fund liquidation selling pressure took some profits.

The cattle market usually trades at an inverse to grain, with lower grain prices meaning higher cattle prices and vice versa. That relationship is certainly at play in the current environment, with the downturn in cattle coming at the same time as grains showed recovery off their own lows.

Macros

Much like shifting weather forecasts are outside of our control, there are several other big-picture factors to watch. The recent drone attack on the Kremlin highlighted the ongoing conflict between Russia and Ukraine, with questions over grain movement through the Black Sea keeping markets on edge ahead of a mid-May deadline to extend the shipping agreement. U.S. bank failures and central bank interest rate adjustments have also led to speculative profit-taking as they look to reduce exposure to volatility.

In the face of such market uncertainty, the same “just keep pushing” attitude needed to cross a continent can go a long way.